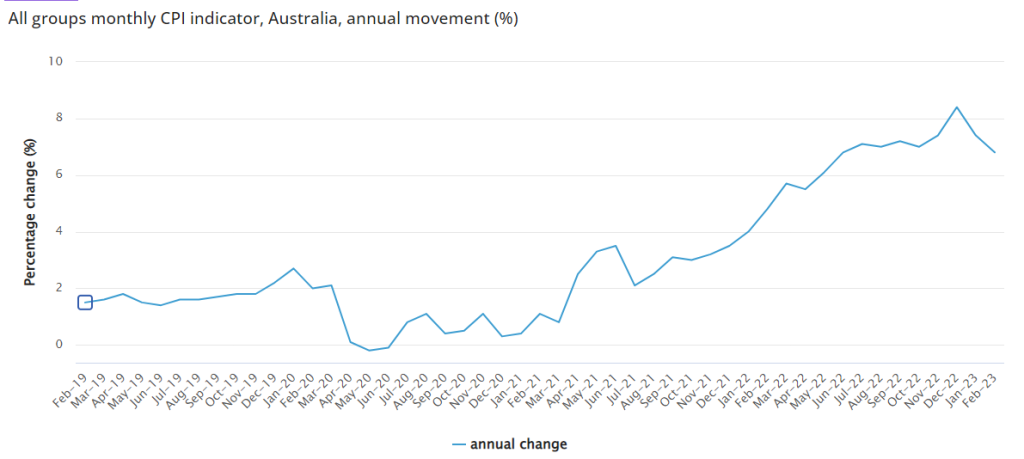

Australia’s inflation rate has slowed to 6.8 per cent in February, lower than the 7.4 per cent rise reported in January – indicating the nation may have passed the peak of the current inflation cycle.

The new data from the Australian Bureau of Statistics released on Wednesday builds the case for an interest rate pause when the Reserve Bank board meets next week.

“This month’s annual increase of 6.8 per cent is lower than the 7.4 per cent annual rise reported in January 2023,” Michelle Marquardt, ABS head of prices statistics, said. “This marks the second consecutive month of lower annual inflation, also known as ‘disinflation’, from the peak of 8.4 per cent in December 2022.”

The new monthly indicator is designed to measure the change in the price of a basket of goods and services consumed by households and was flagged by the Reserve Bank as one of the key pieces of economic data to absorb ahead of the April cash rate decision.

Housing made up the largest contribution at 9.9 per cent but was down from 10.4 per cent in January. Australia’s continued rental crisis saw rent prices rise again, maintaining the 4.8 per cent annual growth recorded in January.

“New dwellings grew 13.0 per cent in the 12 months to February which is the lowest annual growth since February 2022 as price rises for building materials continue to ease,” Ms Marquardt said.

Other significant inflation contributors included food and non-alcoholic beverages (+8.0 per cent), transport (+5.6 per cent) and recreation and culture (+6.4 per cent).

Prices for Food and non-alcoholic beverages eased slightly from an annual rise of 8.2 per cent in January to 8.0 per cent in February. Meals out and takeaway food (+7.3 per cent) was the main contributor to the annual increase, followed by Food products (+11.8 per cent),

Bread and cereal products (+12.5 per cent) and Dairy and related products (+14.3 per cent).