With $1 trillion in assets and unrivaled returns, the private equity giant has conquered Wall Street, but its 76-year old founder, Steve Schwarzman, isn’t finished. He wants total domination overseas as well— and the firm’s crown prince, Jonathan Gray, has built an ingenious weapon targeting vast amounts of global wealth.

It is September 2023. Billionaire founder and CEO of Blackstone, Steve Schwarzman, is in Paris mingling with his senior European staff at a party to christen the private equity giant’s new 26,000-square-foot office.

Beside him, in the courtyard of the elegant 18th-century building, is Gérard Errera, chairman of Blackstone France and former French ambassador to the United Kingdom.

That morning Schwarzman gave the keynote address to a gathering of more than 2,000 of Europe’s biggest investors and family offices at International Private Equity Market’s annual conference. It has been a European whirlwind for Schwarzman.

The day prior, the 76-year-old was in Frankfurt, Germany, opening a 14,000-square-foot Blackstone office on the top floor of a glass-and-steel skyscraper in the heart of the city’s financial district.

“I’ve been to a lot of office openings in my life, but it’s [more] exciting now,” says Schwarzman from his Park Avenue home base. “The farther you get from headquarters, the more effort you have to make to make sure the culture is the same and the risk on deals is consistent.”

As the firm expands globally—it now has 17 offices around the world and has more than doubled its overseas headcount in just five years—Blackstone President and COO Jonathan Gray is on the road constantly, often in New York only for the weekly Monday all-hands meeting.

While Schwarzman was in Paris, Gray was 3,600 miles away, en route to Toronto, where Blackstone is opening its first office in Canada. That trip came just before his visit to Blackstone Singapore, which expects to double its headcount to 200 within two years.

Even when Gray is in New York he’s “traveling,” typically spending the hours around dawn talking to lieutenants in Mumbai as he walks to headquarters.

India is important. Blackstone owns 40 companies there and is the country’s largest commercial real estate operator.

The subcontinent has been the private equity firm’s top-performing market. Last May it took India’s largest mall operator, Nexus, public through a $1.9 billion Real Estate Investment Trust.

Blackstone is mounting this international blitzkrieg because that’s where the money is. U.S. institutional investors—who have already allocated 25% and more to private equity funds—aren’t looking to invest much more in the sector.

But globally, investment in private assets is in its infancy. It’s a huge opportunity.

According to Capital IQ, privately held companies with more than $250 million in revenue account for 86% of investable businesses.

Moreover, Blackstone estimates there is $80 trillion of individual investor wealth globally, much of it idling in European enclaves like Zurich and Paris and in Asia from Tokyo to Seoul to Mumbai.

If you get Schwarzman, whose net worth currently hovers around $38 billion, talking about the business he created in 1985, you’ll soon realize that the old leveraged buyout game that he helped perfect is going through a revolution.

In the United States, traditional private equity—raising money from large institutions to acquire stodgy companies, taking on mounds of debt and then slashing costs and rejiggering the capital structure for quick profits—is dying, or, at best, a slow-growth business.

There are more than 2,000 private equity firms today, up from fewer than 500 a decade ago.

Perpetual capital, perpetual profits

Buyout funds without maturities or drawdowns, often with individual investor-friendly features, are Blackstone’s fastest-growing product.

The new game, dubbed alternatives, is all about growth. Firms buy companies in areas like logistics, infrastructure, life sciences and e-commerce, and make them bigger, not smaller.

Unlike old-school buyouts in which fund lifespans were limited to ten or 12 years, contributing to a slash-and-churn culture, the hottest funding source in the business is now something called perpetuals: buyout funds that are often individual investor–friendly and have no end date.

Like Warren Buffett’s Berkshire Hathaway, Blackstone’s new schtick is buy and hold, and the new funds enforce this by limiting redemptions.

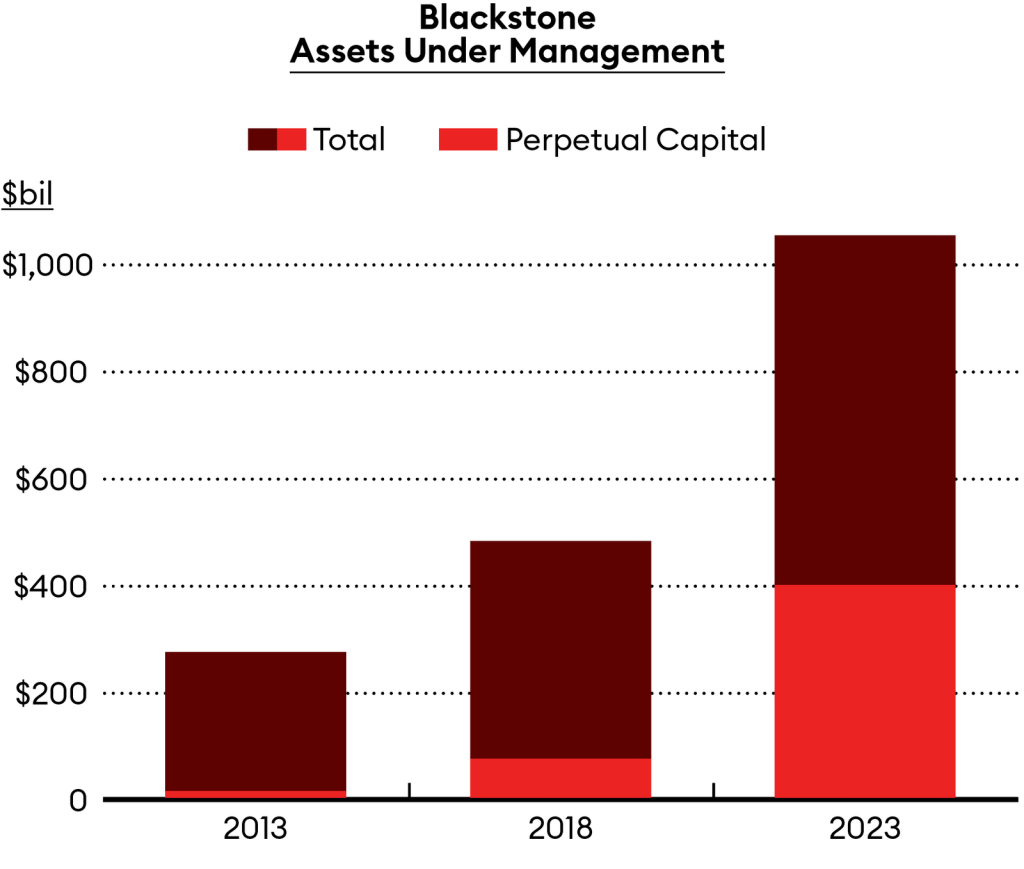

Up from almost nothing a decade ago, these novel perpetual funds now account for 38% of Blackstone’s $1 trillion in assets under management and even more of its fee income.

Gray invented perpetuals at Blackstone, and the 54-year-old is leading the charge to remake the firm into the world’s biggest full-service capital provider, directly challenging old-school mega money centers like JPMorgan, BNP Paribas and HSBC.

In lending, Blackstone’s booming credit and insurance operation already has $319 billion in assets and is sucking in capital from insurance clients eager to trade the costs associated with investing in public bond markets for yields higher by 150 basis points.

“This is not your father or mother’s private equity,” says Gray, whose own net worth is north of $7 billion. “The business has changed. Who would’ve thought that a private equity firm would have the lowest-cost capital? I’m lending out single-A and double-A credit.”

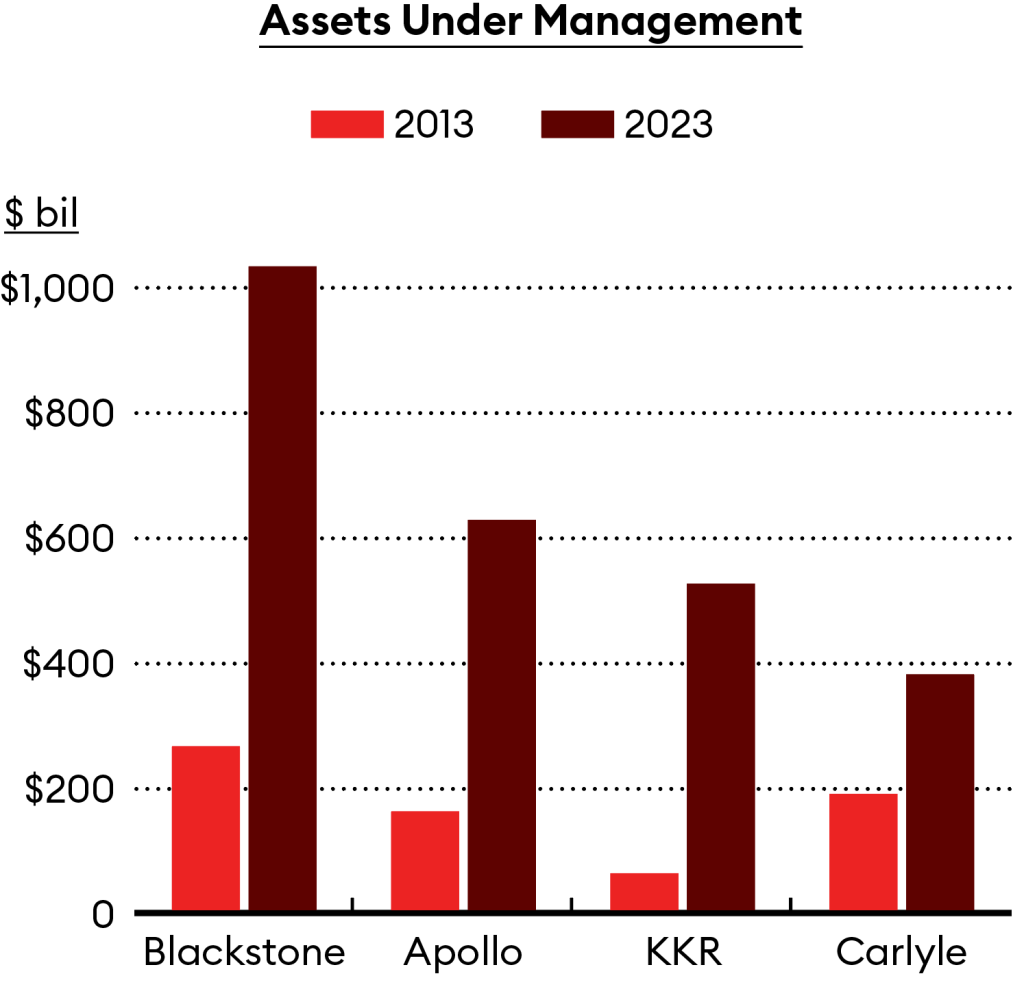

Blackstone, which in September became the first alternative asset manager to join the S&P 500, already owns some 230 different companies around the world that employ more than 650,000 people, far outpacing rivals like Apollo and KKR.

Its $337 billion portfolio of commercial real estate is unrivaled, comprising 12,000 properties covering 1.1 billion square feet globally.

“It’s still early enough that there’s kind of a land rush—everybody sees that this is going to be a global game, both in fundraising and deployment,” says Oppenheimer analyst Chris Kotowski.

Gray is practically jubilant. “Alternatives are coming of age because investors have realized that it’s okay, that this trading of liquidity for higher returns can apply beyond just the highest-octane spaces,” he says in reference to the buyout funds of yore. “And that means the market for what we do has grown a lot.”

Among wall street’s new masters of the universe, few are as unassuming as Jonathan Gray. He is the consummate company man, having landed at Blackstone in 1992 fresh out of the University of Pennsylvania, where he double majored in English and finance.

He was raised middle class in the suburbs of Chicago. His parents divorced when he was 6.

“It made me acutely aware that the steady ground can suddenly fall away,” said Gray last summer during the commencement speech he gave at his daughter’s prep school.

At his own high school in Highland Park, Illinois, he was pimply, never had a girlfriend and was terrified of public speaking. “I was not Mr. Popular, a star athlete or a Model U.N. captain,” he said.

Everyone at Blackstone knows the story of how he spent his junior year warming the bench during a season in which Highland Park won one game and lost 23.

Gray started at Blackstone in 1992. He spent his first year as an analyst in New York crunching numbers and preparing pitchbooks for senior staffers.

He soon gained a reputation as a sponge for details. His cubicle was adjacent to that of John Schreiber, a Chicago-based head of Blackstone real estate.

“He used to hang over the cubicle and ask a gazillion questions,” recalls Schreiber, now 77.

By 2005, when Gray was 34, Schwarzman appointed him head of the firm’s growing real estate division. According to Schwarzman, Gray distinguished himself with a pair of astute strategic insights that led to two of Blackstone’s most profitable deals.

He was early to embrace CMBS, or commercial mortgage-backed securities, which would allow Blackstone to do larger deals at a lower cost.

Gray also saw that Blackstone could buy publicly traded real estate companies—many whose owners had acquired properties over many years—for less than the sum of their individual holdings.

The two seminal transactions both occurred in 2007 as the real estate market was peaking. The first was the acquisition of Sam Zell’s massive Equity Office Properties for $39 billion.

Uneasy about the frothy market, Schwarzman instructed Gray and team to sell off nearly $30 billion worth of properties immediately. That took most of the risk out of the deal, but the firm kept choice properties in New York, Boston and California.

Blackstone partners ultimately tripled their investment.

The other greatest hit: Blackstone’s $26 billion acquisition of Hilton Worldwide, which included properties like New York’s Waldorf Astoria and Hilton Hawaiian Village. The deal closed in October 2007, just as the global financial system was teetering on the precipice of collapse.

The transaction took about six years to right itself, but it taught Gray that even if you overpay for good assets with strong brands, the returns can be great—with proper management and financial support.

During the depths of the recession Blackstone wrote down the Hilton investment by 71%, but Gray persevered, bought back its debt at deep discounts and poured another $800 million back into in the company.

After taking Hilton public in 2013, Blackstone realized its biggest win ever, some $14 billion in profit.

With most of the firm’s profits coming from the $115 billion real estate business Gray built, Schwarzman named him president and chief operating officer in 2018, succeeding another Blackstone-minted billionaire, former vice chairman Tony James.

Blackstone’s traditional institutional buyout fund businesses, with $641 billion in assets, remain a powerhouse. But two others are driving most of the new growth.

The steep rise in interest rates over the last two years, coupled with a pullback in lending among banks, has created a boom in so-called private credit or nonbank direct lending.

In September, Blackstone combined its credit and insurance businesses and has been busy reeling in insurance clients, long accustomed to investing in publicly traded bonds. It now has $319 billion in assets.

“If you think about a life insurance company with 30-year liabilities, why are they paying so much for liquidity when they just hold the bond to maturity?” Gray asks, referring to the costs of public market bonds, including underwriting and rating-agency fees.

“One megatrend is the migration of credit from a purely liquid asset class to a class that will have a substantial minority portion in privates.”

Blackstone now offers investment-grade debt to insurers at yields 150 basis points higher than similar bonds. “One megatrend is the migration of credit from a purely liquid asset class to a class that will have a substantial minority portion in privates,” Gray says.

According to the National Association of Insurance Commissioners, in the United States alone insurers held more than $5 trillion in bonds at the end of 2022.

How much is a “substantial minority”? Gray reckons 20%.

“This will be a global phenomenon,” he says. “It’s gonna happen here, it’s gonna happen everywhere.”

The other growth driver Blackstone is banking on will come from the rich investor clients of wealth managers around the world. Already $240 billion, or nearly a quarter, of Blackstone’s assets come from retail investors, growing at a compound annual rate of more than 30%.

This is where Gray’s other innovation, so-called perpetuals, will play a critical role. Around 2015, Gray took a hard look at what was available to individuals wanting to invest in buildings and other institutional-quality commercial real estate.

Outside of risky one-off properties, they could invest in volatile publicly traded REITs or relatively illiquid, nontraded private REITs that lacked transparency and had steep upfront fees as high as 12%.

“Our insight was, what if we brought Blackstone best-in-class real estate skills and we charged basically what you charge institutional investors?” Gray says.

In 2017, he launched Blackstone Real Estate Income Trust (BREIT), a mutual fund–like product for brokers, which had $2,500 minimums and charged a 1.25% advisory fee, a 12.5% performance fee and a hurdle rate of 5%.

Unlike traditional private equity funds, there were no drawdowns or maturities, and investors’ capital would be put to work immediately.

Another investor-friendly feature: At tax time, these funds issued 1099s instead of the K-1s issued to limited partners, which are considered a nuisance. The catch was redemptions would be limited to no more than 2% of net assets per month or 5% per quarter.

Gray’s invention flew off the shelves of brokers like Merrill Lynch, Morgan Stanley and UBS, which often tacked on their own sales charge. By 2021 assets in BREIT, which owns student apartments, data centers and warehouses, climbed to $70 billion.

Then, as markets fell in 2022, a rush of redemption requests from nervous investors forced Blackstone to limit withdrawals, and assets fell to $61 billion.

Gray insists that BREIT performed as intended, and notes that including monthly dividends, it has logged an annual rate of return of about 11%.

BREIT’s success spawned Blackstone Private Credit Fund (BCRED), which launched in 2021 and now has $29 billion in assets. Blackstone’s competitors, including Apollo and KKR, are also in the game.

It’s estimated that more than $1.2 trillion has poured into perpetual products.

“We went from distributing our drawdown funds to now having a full suite of open-ended funds,” says Joan Solotar, head of Blackstone global private wealth. “They allow you to be out in the market every day, as opposed to episodically every few years.”

Blackstone perpetuals are not only for wealthy individuals. Institutions love them too.

Blackstone Infrastructure Partners (BIP) has $32 billion in assets, Blackstone Property Partners $66 billion.

Don’t think for a minute that these novel funds are merely old wine in new bottles. Perpetuals are changing Blackstone’s operating model itself.

The firm recently launched Blackstone Private Equity Strategies Fund (BXPE), which is essentially its original buyout businesses packaged as an individual investor–friendly fund. As of early January, BXPE had brought in $1.3 billion.

“We’ll have a series of these new products all the time,” Schwarzman crows. “The distributors have, like, 2% in alternatives, and they want to get their customer base to 10% to 15%. So it’s another one of these explosive potential growth areas where we’re positioned as the number one firm in the world.”

Of Blackstone’s $1 trillion in assets, some 70% is invested in North America, 20% in Europe and 10% in Asia. It has a sizable footprint outside the United States, with 1,250 people working in offices overseas—but it’s about to get a lot bigger.

Sitting in a conference room on the 10th floor of the Marunouchi Building in Tokyo’s financial district are Daisuke Kitta, head of real estate in Japan for Blackstone; private equity dealmaker Atsuhiko Sakamoto; and Ryusuke Shigetomi, the chairman of the 75-person operation.

Shigetomi joined in 2021 after serving as vice chairman of global investment banking at Morgan Stanley, and before that at Mitsubishi UFJ Financial.

Much like former ambassador Gérard Errera in France, the 40-year finance veteran’s role is to open doors in a heavily regulated market dominated by big banks.

Dominating dealmaker

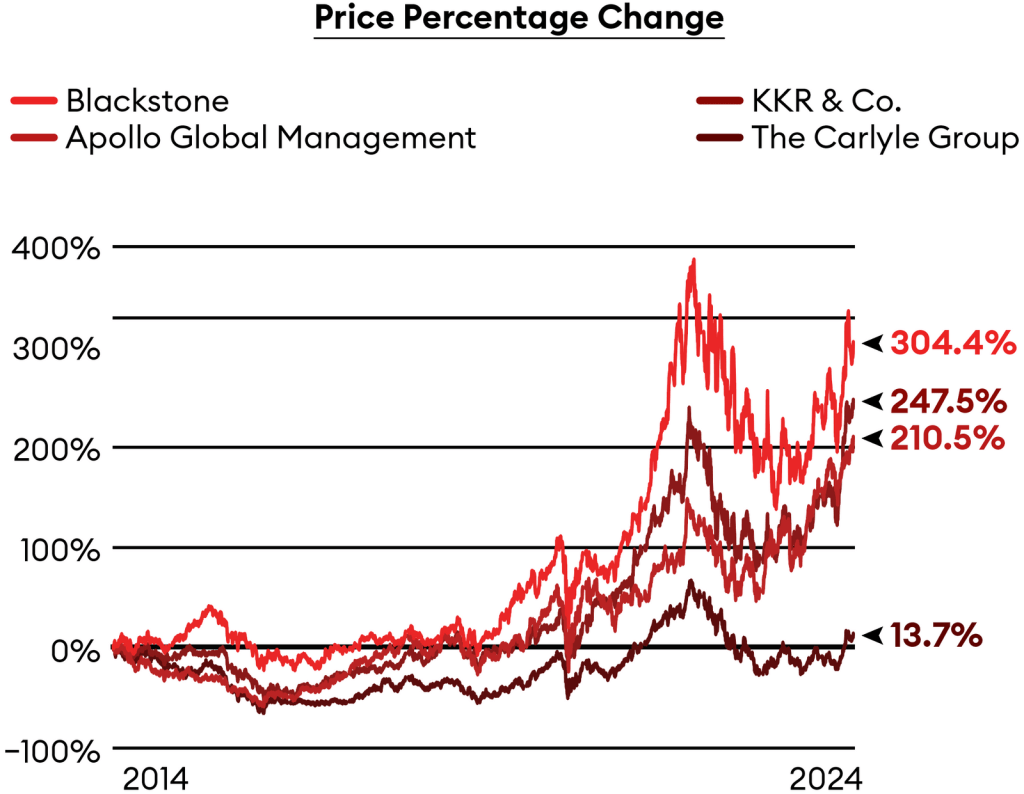

Over the last ten years, innovative deals and products have helped Blackstone widen its lead over its publicly traded private equity peers.

“Our job is to connect the dots between Japan and the U.S.,” says Kitta, who is accustomed to getting rapid-fire emails from Gray about deals. “Jon will email me for something small because he simply wants to ask the questions—and he does that all the time.”

Blackstone has already invested nearly $7 billion in Japanese real estate.

When Blackstone was negotiating to buy Alinamin Pharmaceuticals in 2020 from Takeda Pharmaceuticals, the pandemic broke out, but Blackstone’s local team was able to conduct in-person visits and close the deal while international travel to Japan was restricted.

The $2.3 billion deal remains the country’s largest in health care.

According to data research firm Altrata, Japan has the world’s fourth-largest number of high-net-worth individuals, behind the United States, China and Germany. The country’s government estimates that some $13 trillion in personal financial assets are held by its citizens.

About 50% of that is in cash and low-yield bank deposits. In good news for Blackstone, government reforms are finally opening up the country’s $5 trillion asset management business.

“We will push hard to encourage sophisticated asset management and to solicit new entrants,” said Prime Minister Fumio Kishida recently.

Already, Blackstone has partnered with Tokyo-based Nomura Securities, raising funds for BREIT and Daiwa Securities, whose clients have been pumping yen into BCRED’s floating rate debt. “We have kept pretty close dialogue with the financial institutions,” Shigetomi says.

Though London is by far Blackstone’s biggest overseas outpost, with 600 employees and a new office tower being erected in Mayfair, continental Europe has become a fertile spot for new business.

“Real estate is a relationship business, so you have to be a part of the fabric in local markets,” says James Seppala, head of Blackstone European Real Estate, who speaks five languages.

Last year was a big one: Some 50% of Blackstone’s real estate business came from Europe, where the theme is logistics, logistics, logistics.

The firm is Europe’s biggest landlord, with over $100 billion in assets across the continent, half of which is in warehouses, distribution facilities and fulfillment centers.

In France, where the company already has $25 billion invested, Blackstone hired managing director of credit Florent Trichet in 2022.

“Distributors like private banks around the country want you to speak in French, and they want materials in French, so it makes sense having someone on the ground who can explain the product to investors,” says Trichet. “You don’t want to have people in a meeting getting anxious because they have a Eurostar or flight to catch.”

Like private credit and real estate, perpetuals will play a big role in Blackstone’s quest for world domination. Don’t think for a minute that these novel funds are merely old wine in new bottles—a clever device to vacuum up the cash of wealthy investors.

Perpetuals are changing Blackstone’s operating model itself, away from transactional, toward long-term buy-and-build. They’re also helping the firm win deals.

“We partnered with the family that owned Carrix, the largest port operator in the U.S and Mexico. And with the Benetton family on the privatization of Mundys [formerly Atlantia], which is the largest transportation infrastructure company in the world with a bunch of roadways in Spain and France, and the Rome and Nice airports,” Gray says, referring to deals in Blackstone’s $40 billion infrastructure group. “These families love the idea of partnering with a perpetual vehicle. Because if we tell them we’re gonna buy it and in three years we gotta sell, they’re like, ‘I don’t want that.’ ”

In 2022, instead of selling out of Mileway, a large London-based warehouse operation in 10 countries that Blackstone had built with management over six years, Seppala’s team recapitalized it in a $23 billion deal. Ownership is now in the firm’s perpetual funds.

Blackstone’s investment last year in Paris-based Lazeo is another growth-first deal. The family-run business operates 160 centers to do things like “laser hair removal, injectables, body contouring and medical-grade facials.”

Lazeo has been on a growth tear, having recently purchased Munich-based Cleanskin.

Its founder, Dr. Bernard Sillam, wanted to transfer control to his cofounder son, Dmitri, who needed financing. Cue Blackstone, which pitched itself as a long-term growth partner offering a structure that kept the family in control.

“We knew immediately, after just one call, that we wanted to work with them,” Dmitri says.

Despite the profound changes occurring in private equity, don’t expect Schwarzman or Gray to say a disparaging word about Blackstone’s legacy leveraged buyout work.

“The original business is still a great business,” Gray insists, noting that Blackstone has raised $120 billion in traditionally structured funds in the last two years. “I view it like ice cream: Is vanilla better than chocolate? Everybody has a different objective. Some endowments with very long-term time horizons love these drawdown funds.”

Blackstone recently reported its 2023 results. So-called distributable earnings were $5.1 billion, hampered by drop-in fees from fewer asset sales last year.

Still, assets under management climbed to $1.04 trillion. Thanks to higher interest rates, private credit was the star, reporting the biggest gains among the firm’s strategies.

In terms of distribution, perpetuals continue to shine, rising to nearly $400 billion. As for dry powder, Blackstone has an awe-inspiring $200 billion, and Gray told analysts he’s out hunting for deals.

“One of the key advantages that comes from our leading scale is having more, better and richer private data, which informs how we invest,” said Schwarzman during the earnings call. “We marshal real-time data across these holdings to develop macro insights that we then share across all our businesses, allowing the firm to adapt quickly to changing conditions.”

More boots on the ground overseas will translate into more data, more deals and more dollars in the pockets of Blackstone’s shareholders and its 250 partners. Its shares were up 83% in 2023, compared to 81% for KKR, 49% for Apollo and 24% for the S&P 500.

Last year, dividend payments alone on Schwarzman’s stock holdings amounted to $770 million. Gray’s tally was $139 million.

Schwarzman, who will likely never retire, insists his global ambitions have nothing to do with money.

“I look at anything and say, ‘What’s the maximum we can make this?’ ” he says of his life’s work. “If you see some amazing opportunity, I just get so excited about that. Why shouldn’t we own that? Let’s go.”

This article was first published on forbes.com and all figures are in USD.