Despite Trump’s claims that the U.S. is being cheated in trade deals, globalisation continues to fuel growth here and abroad, lifting the economies and standards of living of nearly every nation on the planet.

Donald Trump has used his first five months back in office to attack longtime allies like Canada, Mexico and the European Union, insisting the United States “will no longer tolerate being ripped off.”

His posture with trade partners has been more competitive than collaborative, imposing or threatening heavy-handed tariffs under the pretense that they’re running up trade deficits to enrich themselves at Americans’ expense. He’s right that U.S. manufacturing jobs have sharply dropped since the turn of the century, gutting industrial cities across America’s heartland that have in turn flocked to him in voting booths. But it’s hard to make the case that globalization has been a zero-sum game.

For the last 23 years, Forbes has compiled the Global 2000 list, ranking the world’s 2,000 largest companies by revenue, profit, assets and market value, with equal weights for each of the four metrics. Twenty years ago, the 2,000 companies on the list combined to record $21.9 trillion in annual sales, $1.3 trillion in profit, $80.7 trillion in assets and $26.6 trillion in market value. Every half decade since, all of those numbers have steadily climbed, and this year’s totals amount to records of $52.9 trillion in revenue, $4.9 trillion in profit, $242.2 trillion in assets and $91.3 trillion in market cap.

Roaring 20s

The rising tide of globalisation has lifted all boats, with the cumulative financials of the list soaring over the last 20 years.

Sales (Trillion) | Profit (Trillion) | Assets (Trillion) | Market Value (Trillion) | |

|---|---|---|---|---|

| 2025 | 52.9 | 4.9 | 242.2 | 91.3 |

| 2020 | 42.3 | 3.3 | 201.4 | 54.3 |

| 2015 | 39 | 2.9 | 162.20 | 48.1 |

| 2010 | 30 | 1.4 | 124 | 31.4 |

| 2005 | 21.9 | 1.3 | 80.7 | 26.6 |

Much of that astounding growth, including more than doubling in revenues has taken place in the U.S., where the S&P 500 index is up fivefold in the last two decades. It’s home to Walmart, the company with the highest 12-month sales in the world, Alphabet, the world’s most profitable company, and Apple, the most valuable company as of April 25, when the data used to rank the list was compiled. (Nvidia, No. 47 on our list, has since surpassed it, with a market value nearing $3.5 trillion).

Now, leaders of many of the most prominent companies in the U.S. and around the world are fretting that a trade war could stunt that growth. Walmart CEO Doug McMillon said on its earnings call in May that “higher tariffs will result in higher prices.” JPMorgan CEO Jamie Dimon devoted the majority of his annual letter to his macroeconomic and geopolitical concerns before even beginning to discuss his own company.

“America will be first—but not if it is alone,” Dimon wrote in a reference to Trump’s “America First” slogan. “If the Western world’s military and economic alliances were to fragment, America itself would inevitably weaken over time.” Last week at Forbes’ annual Iconoclast Summit in New York, one of the world’s greatest investors, billionaire Ken Griffin said the use of tariffs “comes at a dear price to the U.S. consumer“ and said “shame on the administration” for criticizing McMillon in response to his comment about higher prices.

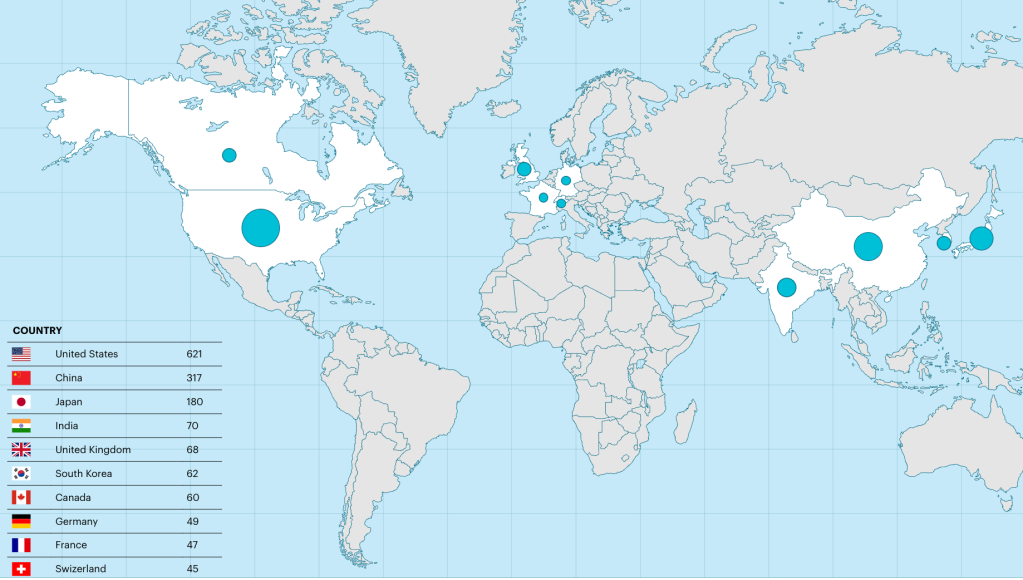

Global Imbalance

The U.S. is maintaining a healthy margin ahead of China and the rest of the world with the most companies on the Global 2000.

Dimon’s cautionary tone shouldn’t be ignored. JPMorgan has been the number one company on Forbes’ Global 2000 for the past three years. His bank’s stock is up 30% in the past year, while the top 100 American companies on the list have gained, on average, 10.5% in market value, underperforming the top 100 companies outside of the United States by three percentage points. In fact, since Trump took office, the S&P 500, which has swung wildly, has gained a mere 0.59%, versus nearly 20% gains for stocks in Europe and China. Over the past 10 years, the top 100 U.S. stocks on our list have an average cumulative return of 488% versus 143% average return for the top 100 stocks outside the United States.

International Improvement

After years of underperformance, the top companies from overseas beat the top American companies in the market last year.

| Top 100 U.S. companies | Top 100 international companies | |

|---|---|---|

| Average 1-year return | 10.50% | 13.20% |

| Average 5-year return | 138.70% | 143.40% |

| Average 10-year return | 488.30% | 143.30% |

As America’s largest bank, with $4.4 trillion in assets, JPMorgan is the only company to rank in the top 20 worldwide in each of the four categories considered for the list. Berkshire Hathaway, the Industrial and Commercial Bank of China, Saudi Aramco and Amazon make up the rest of the top five of the overall Global 2000.

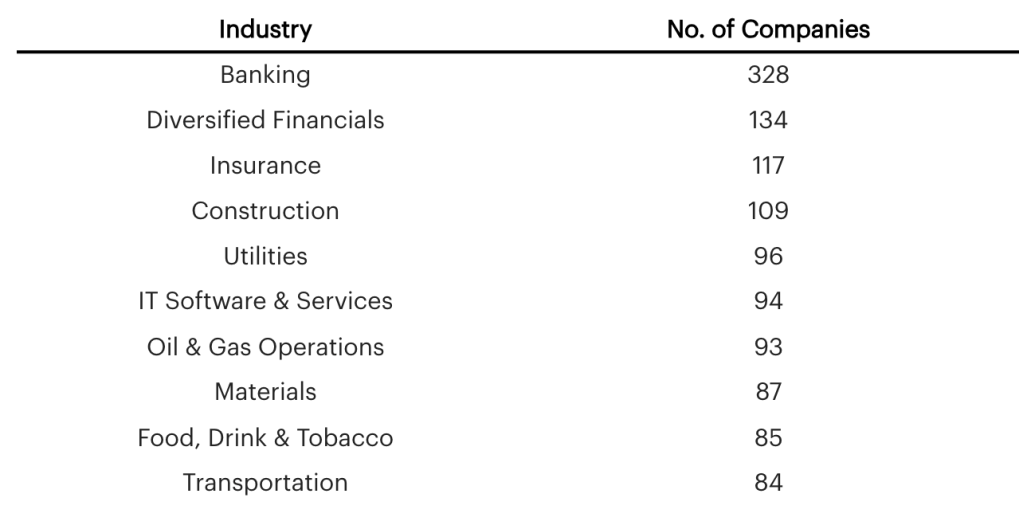

Five of the top eight firms on the list are banks, even as the “magnificent seven” tech companies make up most of the most valuable companies in the world by market cap. Tech giants are generally lighter on assets and don’t get as much credit for that variable. Naturally, banking is the most represented industry, with 328 banks ranging from JPMorgan to $43 billion (assets) Keiyo Bank in Japan represented.

Another 134 companies classified as diversified financials made the cut, including Goldman Sachs (No. 20), Charles Schwab (No. 124) and Blackstone (No. 418). Tech is comparatively underrepresented, with 186 entrants distributed between the software and services, hardware and semiconductors categories. Of the 100 largest companies by assets in the world, 88 are banks, insurers or other financial institutions, giving them a built-in advantage. Banking profits have also been increasing for years thanks to high net interest margins in an environment with rising rates.

Money Movers

Financial institutions are the most well-represented on the Global 2000 thanks to their large asset bases.

While there hasn’t been much movement at the top of Forbes’ Global 2000, there were plenty of significant moves deeper into the list. Artificial intelligence chipmaker extraordinaire Nvidia moved into the top 100 for the first time, shooting up 63 slots to 47th to continue a fast rise through the rankings since its Global 2000 debut in 2006. Disney (71st) and Pfizer (73rd) are also back in the top 100 thanks to a profit rebound after sliding to No. 155 and No. 436 last year, though Pfizer’s stock, with its $130 billion market cap, remains 60% lower than its pandemic-era record high in late 2021.

Moving in the other direction, BP tumbled 374 spots to No. 421 because its profit fell from $9.2 billion to a mere $399 million, hampered by falling oil prices and unexpected refinery outages. Intel similarly plunged from 107th to 488th after booking an astonishing net loss of $19 billion in the last 12 months. The floundering Santa Clara, California-based chipmaker has fallen well behind Nvidia in the AI arms race and has been unprofitable for five quarters in a row, reporting a $16.6 billion loss in last year’s third quarter alone due to write-downs related to restructuring efforts that included laying off 15,000 employees and the depreciation of some manufacturing assets.

In terms of overall numbers, the United States is still first by a wide margin, with 612 companies on the list headquartered here, a slight drop from 621 last year. China is next with 317 companies represented, including firms based in Hong Kong.

In a slow year for IPOs, there aren’t many notable newcomers to the list, but a handful include Smithfield Foods (No. 1,383), AI cloud computing firm CoreWeave (No. 1,799) and SiriusXM Holdings (No. 1,822), which spun off from Liberty Media last September. The highest-ranked new company to join the list is Irish firm Smurfit Westrock at 855th, a near 100-year old paper and packaging firm which formed as a result of a merger between Smurfit Kappa and Westrock last July.Bankers are hoping that Trump’s promises of deregulation will lead to more mergers and IPOs, which could create more movement on next year’s Global 2000, but if this year’s chaotic policy announcements persist, profits for the whole list could come down as more cash gets siphoned into governments’ coffers due to tariffs. The U.S. remains the world’s most powerful economy, and it’s up to Trump and Congress to decide whether what is effectively the tax revenue from government heavy-handedness on trade deals, is worth sacrificing the economic gains the United States and its allies have long benefited from due to globalization.

This story was originally published on forbes.com and all figures are in USD.