From an AI-fuelled stock rally to record-high gold, the signs are stacking up that nearly every asset class is due for a reckoning.

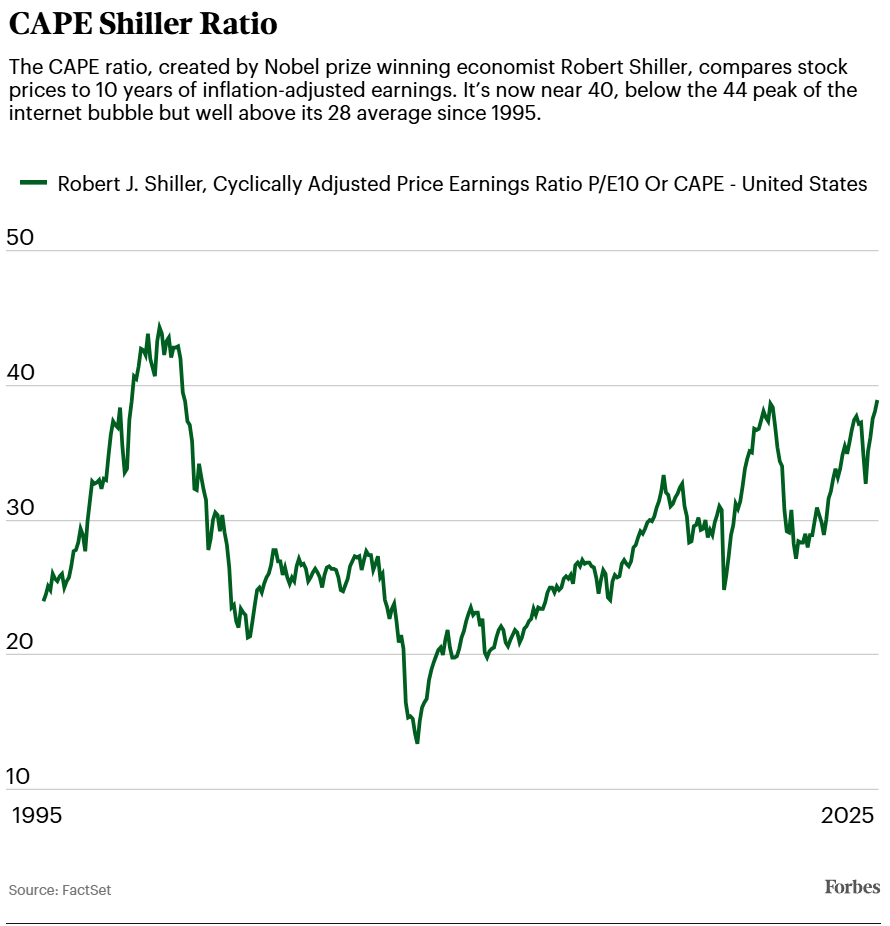

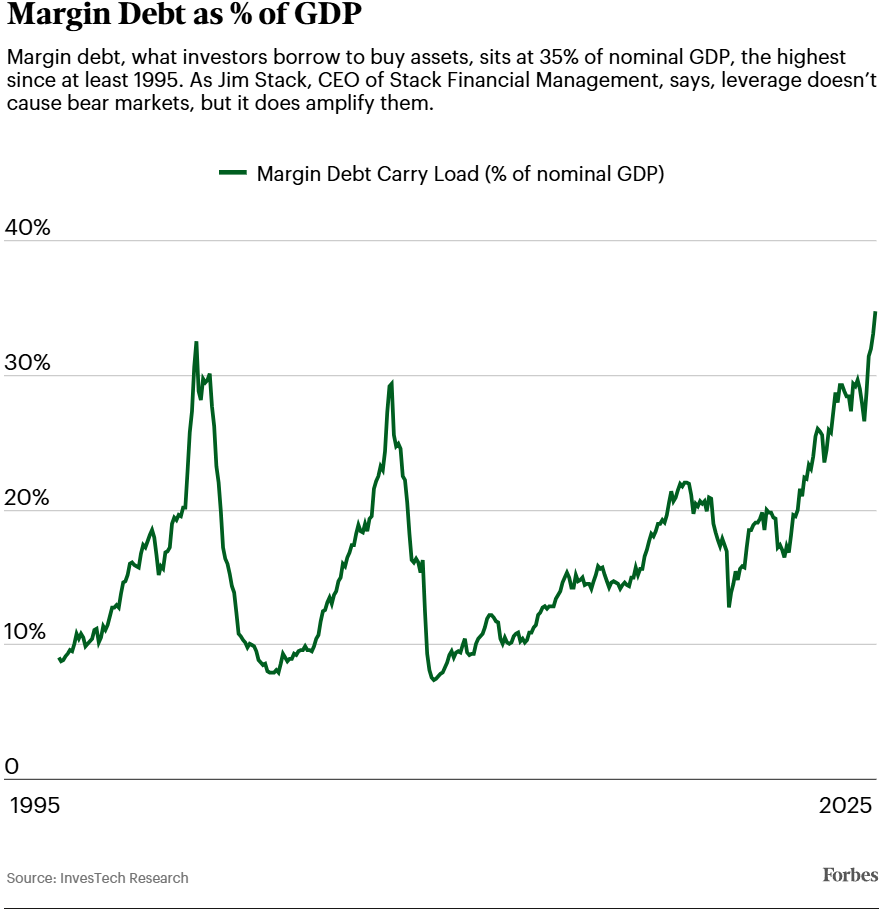

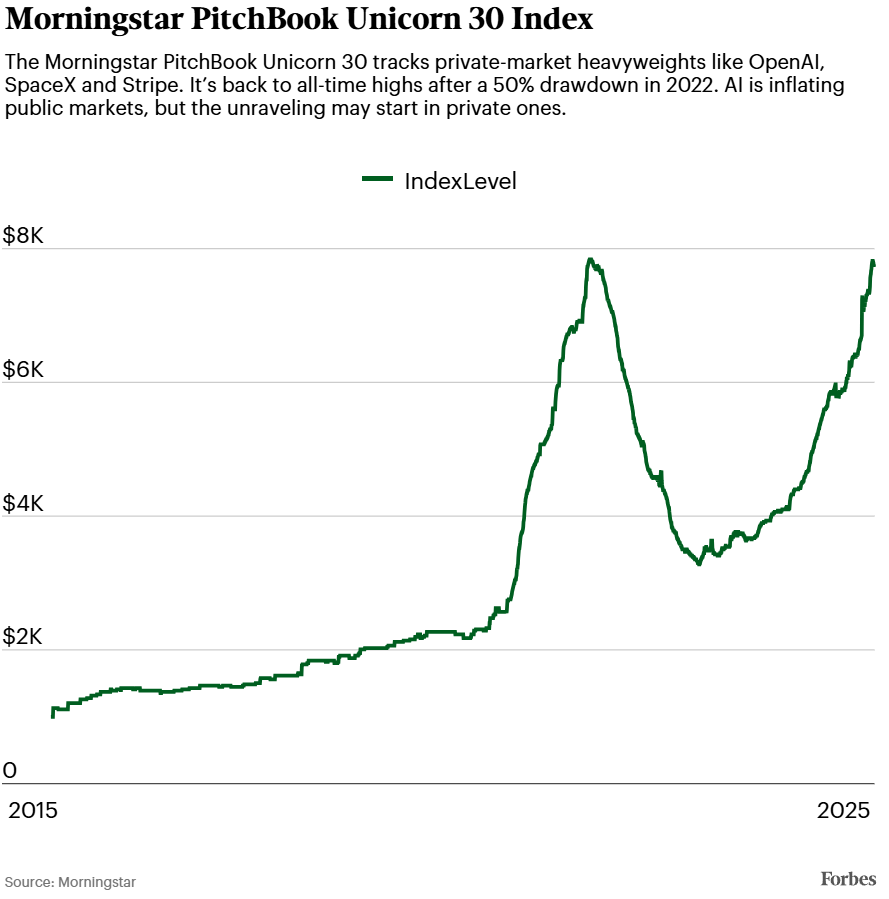

Asset bubbles give off a scent. Stocks far outpace earnings. Junk debt looks gold-plated. But, no matter how good the rally feels, eventually skepticism arises. The question is whether the smoke alarm is chirping from a dead battery or fire? The S&P 500 sits at 6,700, nearly double what it was five years ago. The Magnificent 7 tech titans are the rocket fuel. They account for nearly 40% of the index and they’re placing trillion dollar bets that AI rewires the world.

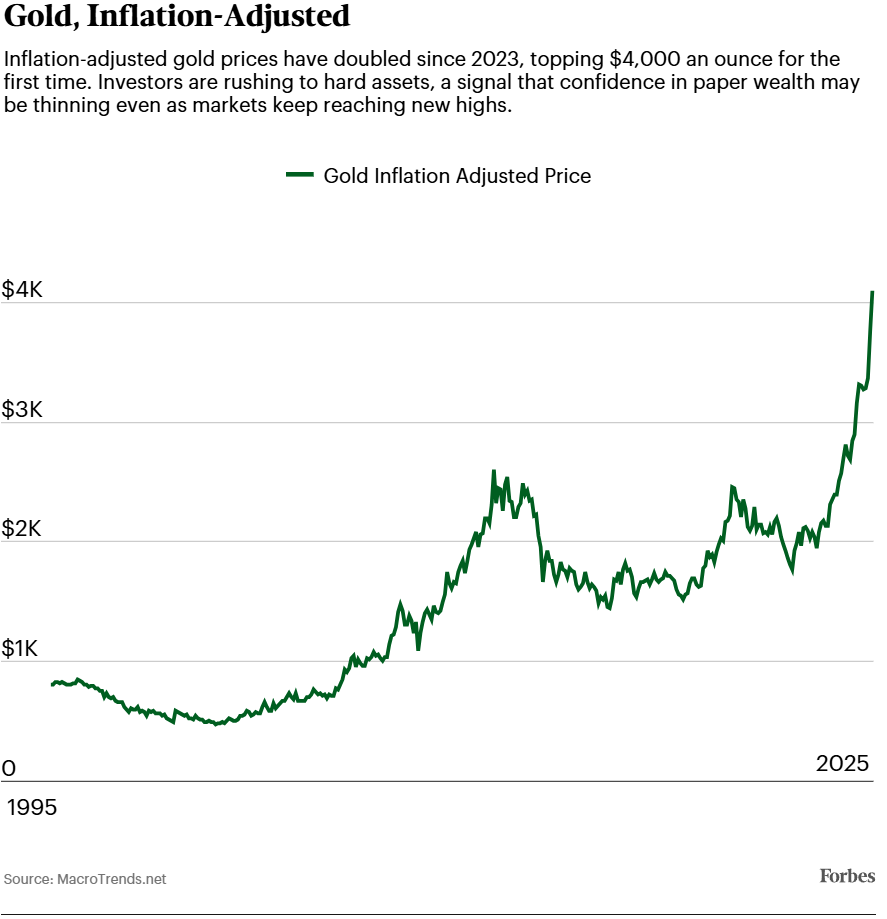

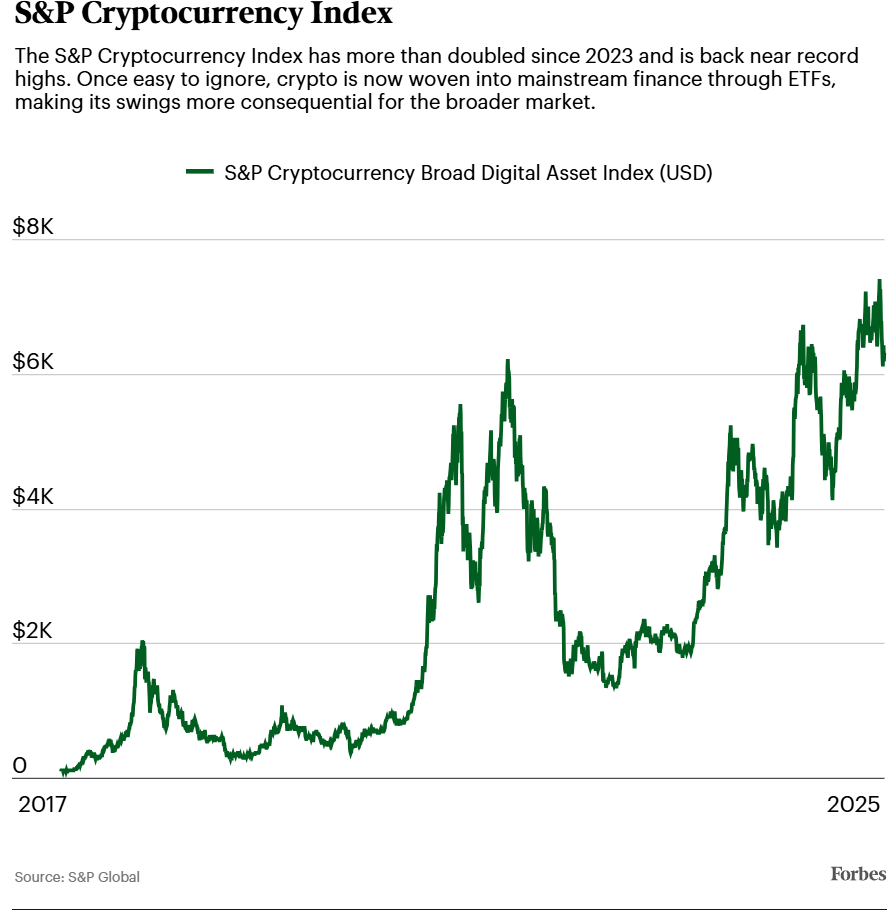

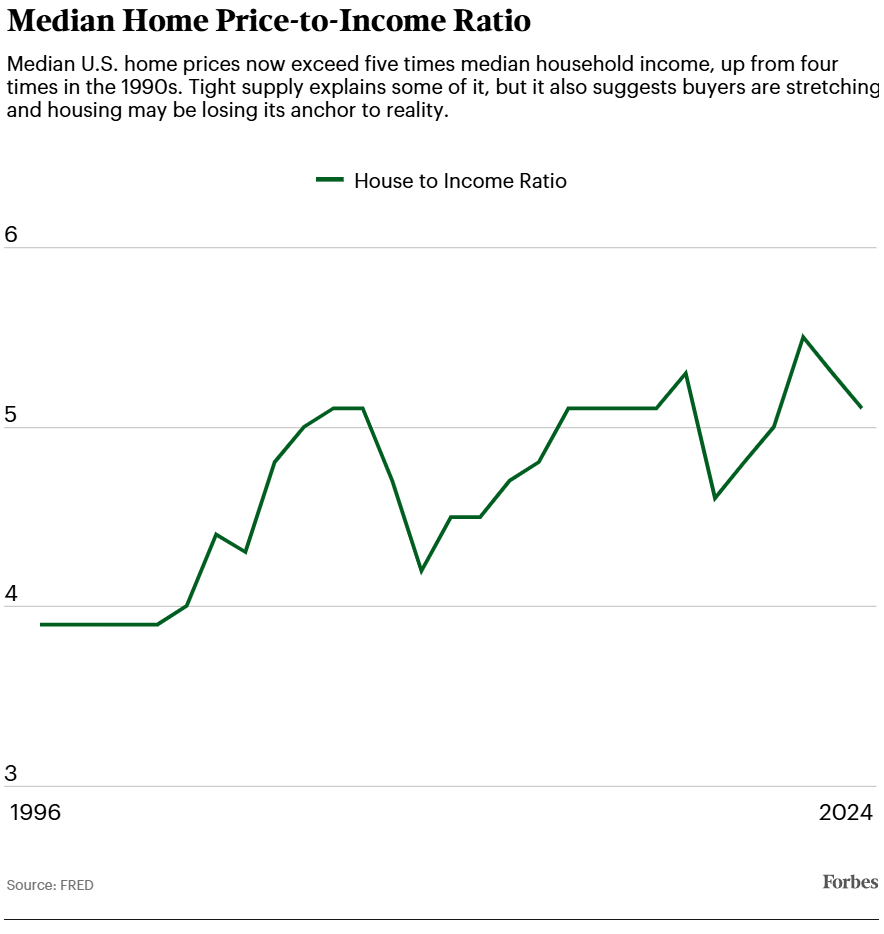

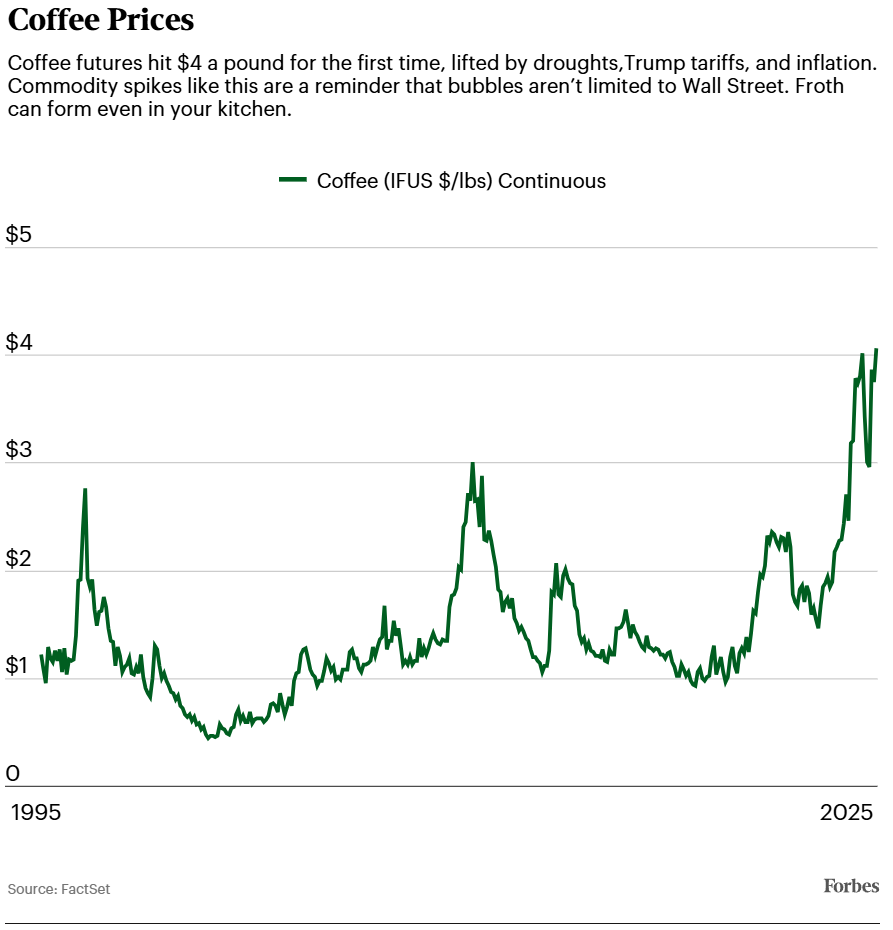

It’s not just frothy stocks. Gold is near record highs as is coffee. Bitcoin, the ultimate risk-on asset, is up more than 130% since it was packaged into exchange traded funds in Jan. 2024. Amid bidding wars, home prices rise further out of reach for buyers. Even junk bonds trade as if nothing can go wrong.

Economist John Kenneth Galbraith wrote that bubbles form the same way every time. A new idea casts a spell. Credit expands. Prices rise. Everyone feels smarter. Then crack, reality bites and it all comes crashing down. Galbraith argued the real fuel isn’t credit, it’s boundless hope and fleeting memory. Each generation convinces itself that this time is different.

Nobody rings a bell at the top, of course. And trusted detectors can sound false alarms.

The yield curve was inverted from June 2022 to August 2024. That usually portends recessions within 24 months. By that rule, the slowdown should have started already.

Yet investors who sold on the signal missed the second strongest start to a rally in half a century. You can blame AI for that too. Deutsche Bank says without spending on AI infrastructure, the U.S. would already be in recession.

That’s one reason why this market feels off.

Perhaps that’s why gold is near a record high, something that rarely happens alongside rising stocks. One reflects optimism, the other fear. It could just be a market hedging its bets. Or maybe it’s a sign some investors have been smelling smoke before the rest of us.

The Smoke Alarms

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.

This story was originally published on forbes.com and all figures are in USD.