Nvidia CEO and cofounder Jensen Huang became a much richer man Thursday as shares of his semiconductor chip company that’s become the poster child of the artificial intelligence movement surged to a fresh all-time high, placing him among the world’s Top 20 wealthiest, according to Forbes calculations.

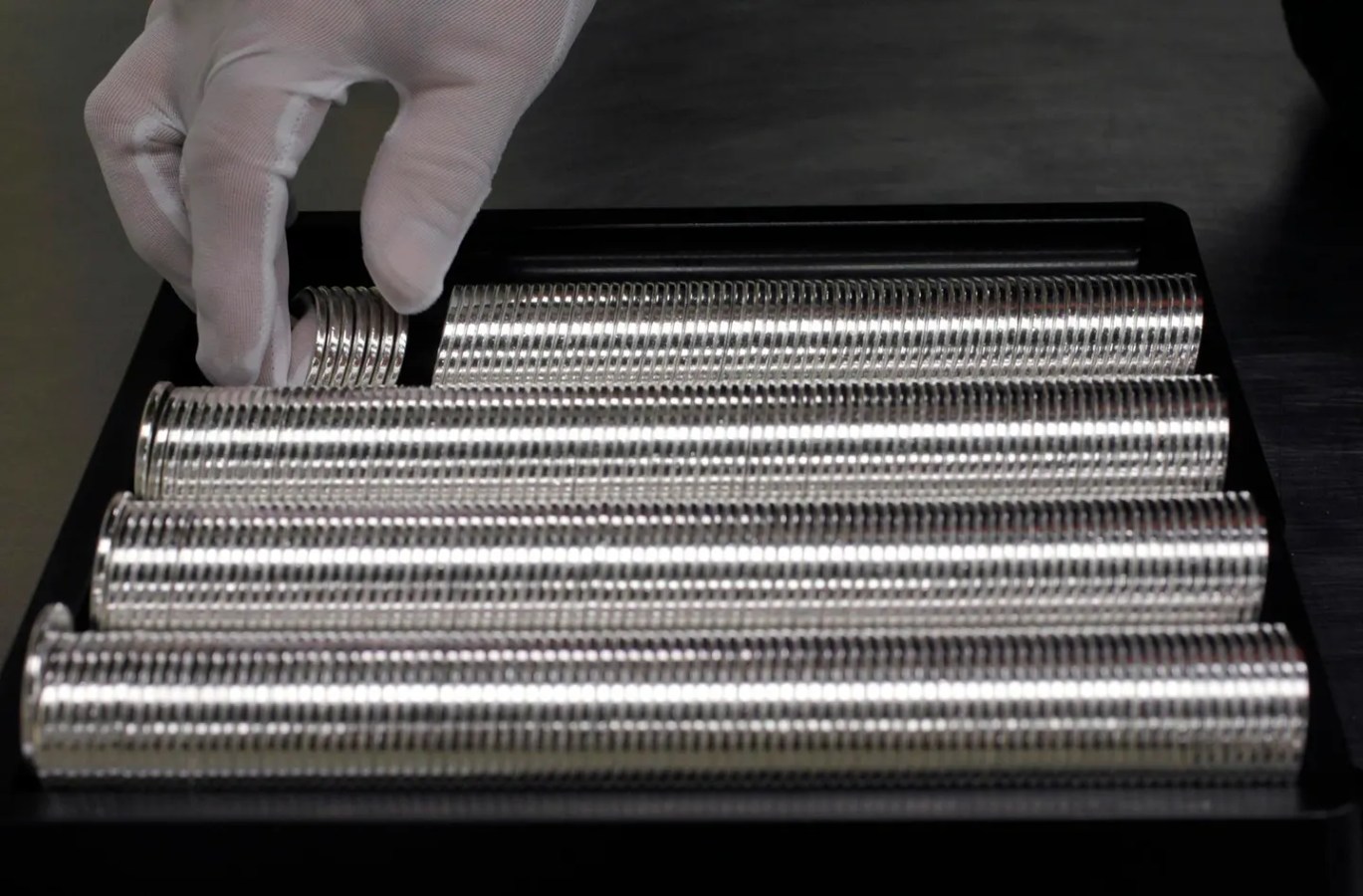

Huang, in his patented black leather jacket, shows off his company’s latest technology.

AFP via Getty Images

Key Takeaways

- Huang’s net worth grew by almost $8 billion Thursday to $91 billion, according to Forbes’ calculations, as Nvidia’s stock rose by 9% to well over $1,000 per share.

- A majority of Huang’s net worth comes from his 3.5% stake in Nvidia, the company he cofounded Nvidia in 1993 and has led as chief executive ever since.

- Huang, who is by far the largest individual shareholder in the company, leapfrogged Indian mogul Gautam Adani to become the 17th-richest person in the world Thursday, having surpassed Walmart heirs Alice, Jim and Rob Walton earlier this week to vault into the top 20.

- It’s a remarkable rise in riches for Huang, who was worth just $4.7 billion as of Forbes’ 2020 billionaires list and $13.5 billion at the beginning of last year, a wealth blossoming attributable to Nvidia stock’s meteoric rise as investors grew infatuated with the Silicon Valley firm’s exponential earnings growth.

Key Background

Nvidia designs the highly coveted semiconductors used to power and store data for generative AI, with Huang boasting Wednesday demand far outstrips supply for the companies’ graphics processing units as the company’s earnings power proves robust. I

ts stock’s rally comes after the company reported blowout quarterly earnings Wednesday afternoon, highlighted by a more than 600% annual increase in profits.

The third-most valuable company in the world, Nvidia added $220 billion in market value on Thursday, growing to a $2.6 trillion market capitalization, a sum larger than the combined valuations of Berkshire Hathaway, JPMorgan Chase and Tesla.

Nvidia has handsomely rewarded long-term shareholders like Nvidia, with shares returning 21,500% over the last decade, 2,500% over the last five years and 115% this year alone.

Even after the valuation spike, Nvidia’s growth story “is clearly nowhere near its end, and likely nowhere near its peak,” according to Bernstein analysts led by Stacy Rasgon.

Big Number

$8.7 million. That’s how much Huang will receive in quarterly dividend payments next month after Nvidia upped its dividend payout by 150% to $0.10 per share before the stock split.

That’s chump change compared to the roughly $175 million in quarterly dividends paid out to Meta CEO Mark Zuckerberg.

Crucial Quote

“The Godfather of AI Jensen and Nvidia delivered another masterpiece quarter,” gushed Wedbush’s Dan Ives in a note to clients, serving among a chorus of reverential Wall Street analysts toward Huang and Nvidia.