Nvidia again shattered Wall Street’s lofty expectations in its quarterly earnings report Wednesday afternoon, sending shares of the Silicon Valley giant surging as the artificial intelligence kingpin maintained its winning streak.

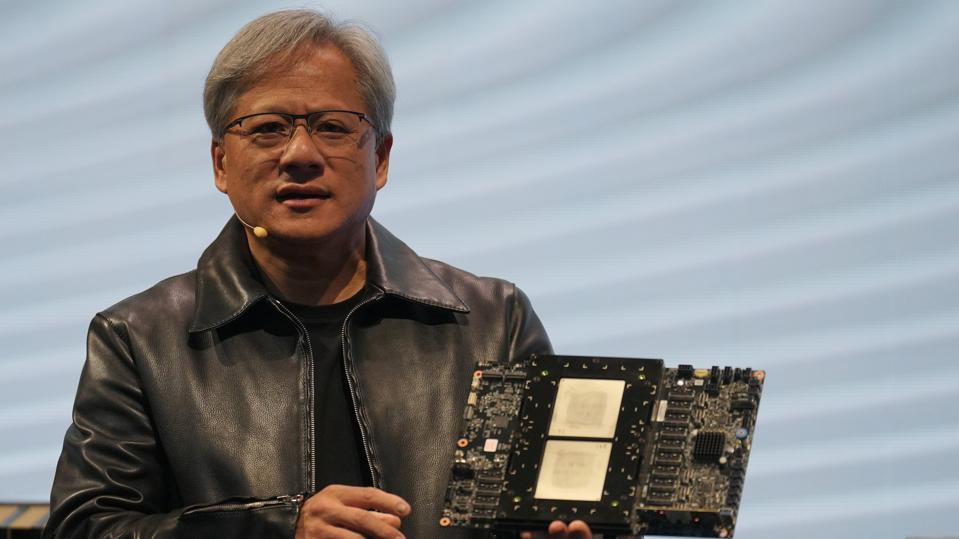

Nvidia’s billionaire CEO Jensen Huang has guided his company to explosive growth in recent months.

SOPA Images/LightRocket via Getty Images

Key Takeaways

- Nvidia brought in $22.1 billion of sales during the three-month period ending last month, 265% higher than the same quarter the year prior and well above average analyst estimates of $20.4 billion, according to FactSet.

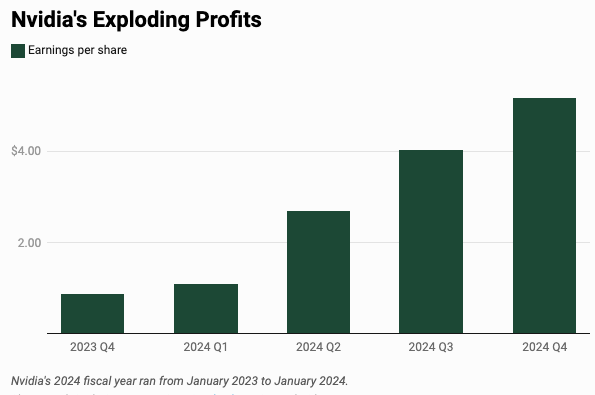

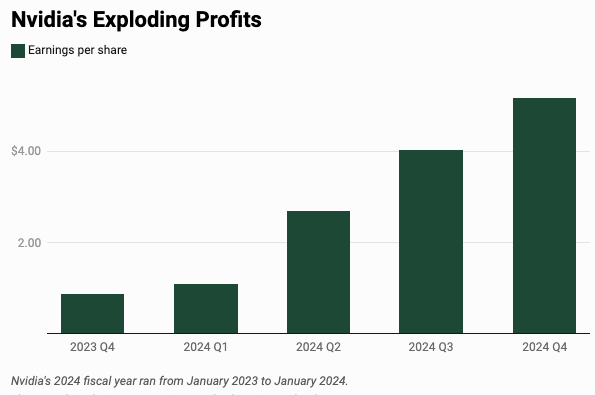

- The firm’s $12.3 billion of Q4 net income resulted in eye-popping year-over-year profit growth of 769%, and its $5.16 adjusted earnings per share shattered estimates of $4.59.

- Nvidia has not missed consensus analyst earnings estimates since the quarter ending October 2022 and hasn’t missed on revenue since before 2020, the extent of FactSet data.

- It’s the firm’s third-consecutive quarter reporting record profits and sales.

- The company also said it expects $24 billion in revenue in the current quarter, beating analyst estimates of $22.2 billion.

- Shares of Nvidia rose about 3% shortly after the earnings release, moving against the 9% selloff dating back to last Wednesday.

Big Number

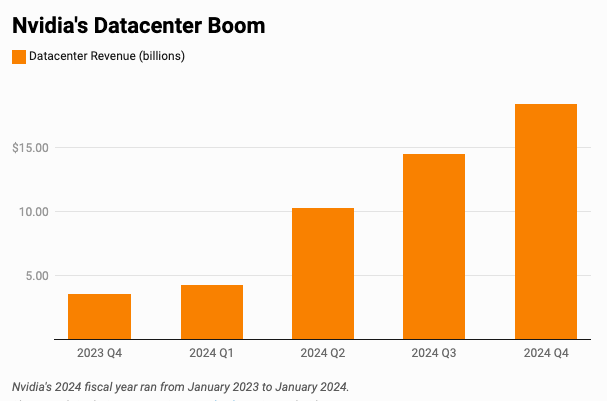

409%. That’s how much sales in Nvidia’s AI-heavy Datacenter division rose during Q4 on an annual basis, surging from $3.6 billion to $18.4 billion.

Key Background

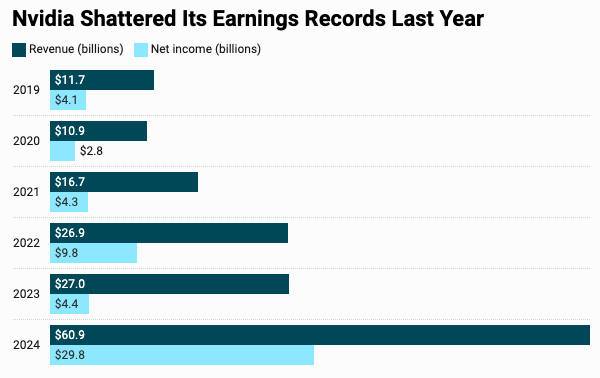

Despite a recent share price decline outpacing a broader tech downturn, Nvidia is the hottest big stock in the U.S. in recent months, as its share price has exploded from below $120 to almost $700 over the past 15 months, sending Nvidia’s market value from just above $300 billion to over $1.7 trillion in the process. Nvidia’s boom coincided with massive, AI-fueled earnings growth—its quarterly profits are more than 10 times higher than they were four years ago—but questions remain on whether Nvidia can deliver the financial results needed to justify its valuation that places it among the most valuable companies in the world. Wall Street analysts are largely convinced that Nvidia can deliver, as average forecasts expect Nvidia’s profits and sales to grow another 60% or more apiece during the current fiscal year.

Crucial Quote

Nvidia’s guidance is “crucial…for the broader market,” LPL Financial’s top global strategist Quincy Crosby wrote in emailed comments, pointing to a “voracious market that expects ever more” out of golden child Nvidia.

This article was first published on forbes.com and all figures are in USD.