Australian buy now, pay later (BNPL) service Openpay has gone into receivership.

An announcement on the Australian Securities Exchange (ASX) confirmed that McGrathNicol has been appointed to the company as receivers and managers.

“The receivers and managers will work closely with Openpay’s employees, merchants and customers to urgently determine the appropriate strategy for the business,” the statement read.

Customers have been locked out and prevented from making new purchases – but anyone with an outstanding balance will still be required to pay off their debt.

“An urgent assessment of the assets under our control are underway and we will be working constructively with all stakeholders, to secure the best possible outcome,” Barry Kogan of McGrathNicol said.

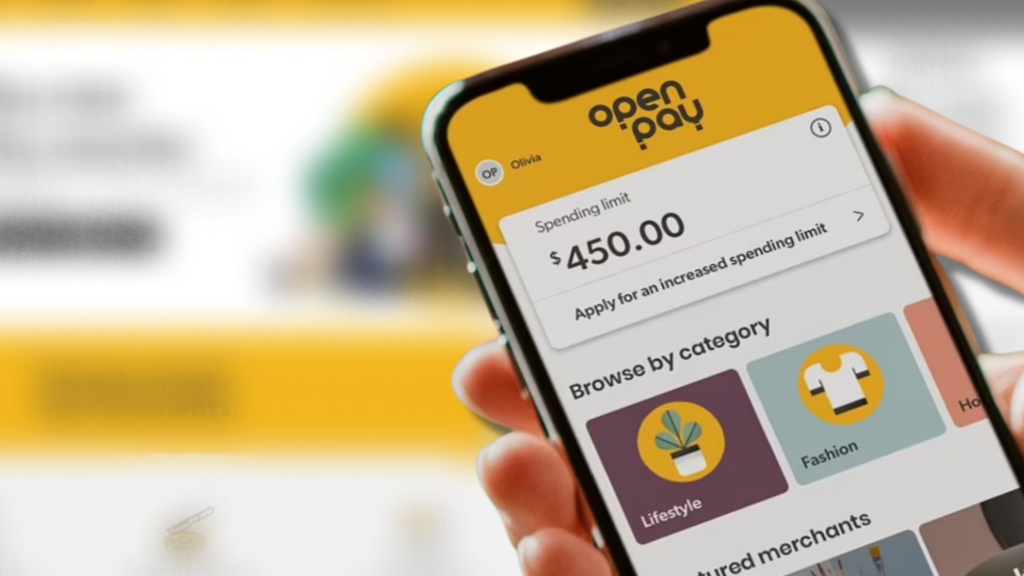

Like other BNPL services, Openpay offers a platform for customers to pay a fee so they can pay off purchases in instalments.

The collapse comes just days after Openpay released its quarterly report where it told shareholders it had an active customer base of 347,000 users.

“While credit performance has softened, it has done so when compared to the pandemic era, where government stimulus was high and Openpay prudently did not relax its underwriting rules,” Openpay chief executive Dion Appel said in the report.