Research shows there is a glaring disconnect between employers and employees when it comes to their perception and their lived experience of financial wellbeing.

We all know prices are going up. It’s been well reported for months now. As employers, what we know less about is the impact that these price increases are having on staff and organisations.

Research into employee financial wellbeing published this week looked at how employees are faring but also how effective employers are in providing support.

The research, conducted by Wagestream and analysed by Good Shepherd, is one of the largest studies into employee financial wellbeing globally, undertaken during a time when inflation is at its highest levels in decades. It involved thousands of employees and 496 human resources professionals across a wide range of industries and business sizes in Australia.

There are some pretty sobering insights and also major opportunities for business leaders. Here’s a quick snapshot:

There is a significant disconnect between employees and employers in perceptions of financial wellbeing supports in the workplace

Though the majority (58%) of HR professionals believe they are supporting their employees’ financial wellbeing, only a minority (36%) of employees feel this is the case. In-depth interviews with HR professionals that believe they are providing financial wellbeing programs found that low take-up is common, even though the desire for this kind of support among employees exists.

This means that more needs to be done to make sure the financial wellbeing programs are relevant to employees. When you consider some of the very immediate financial issues employees are facing, it’s understandable that seminars on superannuation may not be the highest priority.

Why is this financial wellbeing support so important?

Employees on lower incomes are struggling financially

Employees on lower incomes, who are more likely to have been financially affected by the pandemic and current rising costs, are also more likely to be struggling to pay bills and report lower financial security.

This might seem obvious, but it’s an important thing for employers to recognise – particularly when senior leaders are implementing initiatives that impact all employees.

Women are more likely to be on lower incomes and have less financial security

Women in the workplace are more likely to have a savings habit but less in actual savings, are less likely than men to have access to $500 in an emergency and are less likely to self-report their employer offers financial wellbeing support compared to men.

Younger people are also more likely to be on lower incomes and have less in savings, but unlike women are more likely to miss bill payments

Younger employees (18-24 years old) are most likely to have recently missed a bill payment and less likely to feel in control of their spending compared to older age groups. Younger employees were also overrepresented in the sectors where income was negatively impacted during and after the height of the pandemic.

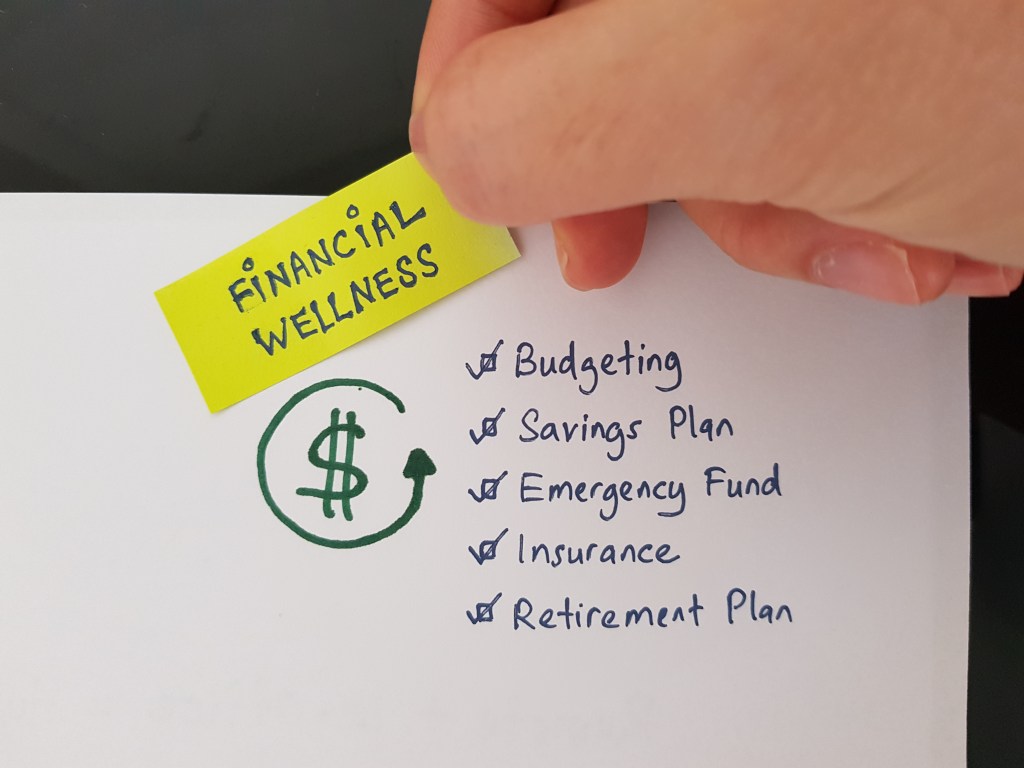

Employees want holistic and relevant financial wellbeing support from their employers

Typically employers have linked financial wellbeing benefits with superannuation and salary sacrifice schemes. While in some instances these programs can be beneficial, it’s clear they do not help employees respond to more immediate financial pressures or help establish good money habits in the short term that will leave employees in a better financial position over the longer term.

The survey of employees showed that the majority of the employee population are interested in:

- Having the money they need for bills put aside on payday

- Technology to help them save

- Repaying debt faster by using earnings before being paid

- Short and interactive courses where they could learn about managing money

- Chatting to a money coach to give them more confidence to manage their money

Organisations have a lot to gain by focusing on financial wellbeing of their employees

On the whole, employees generally trust their employers and want them to do more to support their financial wellbeing. However, trust in employers is lower among lower income earners. Employees are more likely to think favourably of their employer and also stay longer if they feel their financial wellbeing is supported.

There are also potential productivity benefits for employers who support their employees with financial wellbeing. Younger employees (18- 40 years) represent the future of the workforce and are most likely to want financial wellbeing support from their employer.

What next?

Mental wellbeing has long been a focus for leading organisations and now these same organisations are looking to broaden their understanding of wellbeing and provide appropriate support.

Financial wellbeing and mental wellbeing are understood to have a cyclical relationship, where poor mental health can lead to reduced ability to work and cause financial stress. Poor financial wellbeing may also lead to mental wellbeing issues. Recent research from Beyond Blue found that people dealing with financial challenges are at least twice as likely to face mental health issues than others.

Following the instability of Covid-19 and the cost of living increases that have dominated 2022, employers can no longer comfortably sit on the sidelines when there are tools and resources that can be implemented to help employees not only survive current conditions, but thrive into the future.

Josh Vernon is co-founder and CEO of financial wellbeing app Wagestream Australia.

Read the State of Employee Financial Wellbeing