The Chinese e-commerce sites ship the equivalent of 88 Boeing 777 freighters of cargo worldwide every day. The vast volume has sent air freight rates through the roof, but the two companies have been willing to subsidise fast shipping as they grow globally — for now.

Nine months ago, Niall van de Wouw, who tracks air freight shipments across the globe for logistics analytics company Xeneta, had never heard of Temu.

But seemingly overnight, the Chinese e-commerce site, along with another fast-growing competitor Shein, became so popular with American consumers that it spiked prices for fast shipping by airplane from China, creating a cargo crunch that’s altering global trade routes for an air freight industry scrambling to keep up.

“Nobody saw it coming last year,” van de Wouw, Xeneta’s chief air freight officer, told Forbes. “Their volumes could be the same order of magnitude as the largest freight forwarder in the world. Their volumes are crazy.”

At the time, the company was only a year and a half old. “This is very unusual,” he said. “I cannot recall one or two companies producing so much demand. That’s the scary bit about exponential growth.”

Temu, which largely sells clothing and housewares, and Shein, which built its brand on fast-fashion and has since expanded to consumer electronics and kitchen items, are unlike other retailers in that they sell items made directly by no-name Chinese companies, rather than selling an American brand that is made overseas. Part of their low cost has come from their decision to ship directly from China from those manufacturers, rather than working with well-known American brands that impose greater costs, prices, and quality. (The two Chinese companies have gotten so well-known that during Saturday Night Live’s season May 18 finale, the show lampooned a fictional company called “Xiemu.”)

“Shein and Temu have a continuous ‘thirst’ for air freight, which is unparalleled to anything we have seen previously.”

Wenwen Zhang, air freight analyst, Xeneta

But to get customers’ their products in a reasonable amount of time, both companies have been relying heavily on air freight. Temu and Shein combined ship around 9,000 tons of cargo worldwide every day, or approximately 88 Boeing 777 freighters filled to the brim, according to February research from Cargo Facts Consulting. (The scale is comparable to Amazon’s Prime Air fleet, which has 86 aircraft in service, according to Planespotters.)

That’s driven up prices to near-unprecedented levels. According to the latest figures from Xeneta, so far, the May air cargo “average spot rate” from southern China to the U.S. is now at about $4.75 per kilogram, the highest it’s been since the end of last year, rivaling what’s typically peak demand in the run-up to the holiday season. That’s more than double during same period in 2019, when the rate was $2.32 per kilogram.

The rates are still lower than recent peaks in 2020 and 2021, when that rate reached a high of $10 to $12 per kilogram. But those heights were due to the pandemic, which created shipping and supply chain shortages across the globe. Now, analysts say the rise is largely due to just two companies: Temu and Shein.

To keep up, some logistics and airline companies have even begun adding more flights to prepare for more growth. For instance, Atlas Air, an American air freight firm, announced earlier this spring that it would soon launch a second air freight plane into service in partnership with YunExpress, a Chinese shipping company.

Regionally, Korean Air reported earlier this month that it had made $2.8 billion in revenue during the first quarter of 2024, citing “robust cargo demand,” a 20 percent year-over-year increase. The airline added that during the second quarter, its cargo business would “capitalize on the growing e-commerce demand from China by strengthening client partnerships and allocating capacity on key routes.”

This picture shows signage of cross-border fast fashion e-commerce company SHEIN at a garment factory in Guangzhou, in China’s southern Guangdong province on July 18, 2022.

AFP via Getty Images

“Shein and Temu have a continuous ‘thirst’ for air freight, which is unparalleled to anything we have seen previously,” Wenwen Zhang, an air freight analyst with Xeneta, emailed Forbes.

The boom has even impacted global shipping routes. Temu has begun new sea and air routes via Taiwan, Japan and Korea into the U.S., “altering traditional trade patterns,” per a report from Taiwanese shipping company Dimerco. “Consequently, freight rates from these alternative routes are now exceeding those from mainland China—an unusual occurrence.”

Last Monday, the Chinese government also trumpeted a new air cargo route between the southern Chinese city of Zhengzhou and Dallas and Atlanta that are “primarily catering to cross-border e-commerce shipments.”

Sending cargo by air is always considerably faster and more expensive than shipping by sea, which can carry a much larger volume of goods, albeit at a slower pace. The overwhelming majority of worldwide goods as measured by volume are shipped by sea, with typically only time-sensitive and high-value items put on planes.

Then there’s the environmental cost. According to Freightos, an online freight booking marketplace, cargo ships generate approximately 10 to 40 grams of carbon dioxide per metric ton-kilometer traveled, far less than air freight, which emits around 500 grams per metric ton-kilometer. )

For now, Shein and Temu provide free shipping for orders over a certain size, seemingly willing to absorb the higher costs as a shortcut to accelerated growth in the U.S. “Temu and Shein are relying on air freight because their business model is ultra-fast fashion and they need to get all these goods out immediately,” Guillermo Ochovo, the director at Cargo Facts Consulting, told Forbes. “They don’t have any other way than relying on air right now.”

But that could change over the medium to longer-term as the companies look for ways to cut costs now that they’re both established e-commerce platforms. They currently lack a maritime shipping and ground-based domestic logistics network comparable to Amazon or Walmart, but both companies have slowly started to expand their footprint within the United States and Mexico. Shein now has two distribution centers in Indiana and California, and Temu has recently begun working with Chinese sellers already based in the U.S.

“The fact that we are talking about this kind of a market this early in the year is leading a lot of people to thinking how challenging peak season, Q4, will be.”

Brian Bourke, Global Chief Commercial Officer, SEKO Logistics

Air freight’s high costs come in part from largely empty planes that must make the return trip back from the U.S. to China: shipping in that direction costs maybe a fifth of the price to ship from China to the U.S., van de Wouw said.

“You get a full plane to the U.S. and a deadhead on the way back,” he said, using an aviation industry term for a near-empty or fully empty plane. “The backhaul becomes a bloodbath.”

Neither Shein nor Temu responded to Forbes’ request for comment.

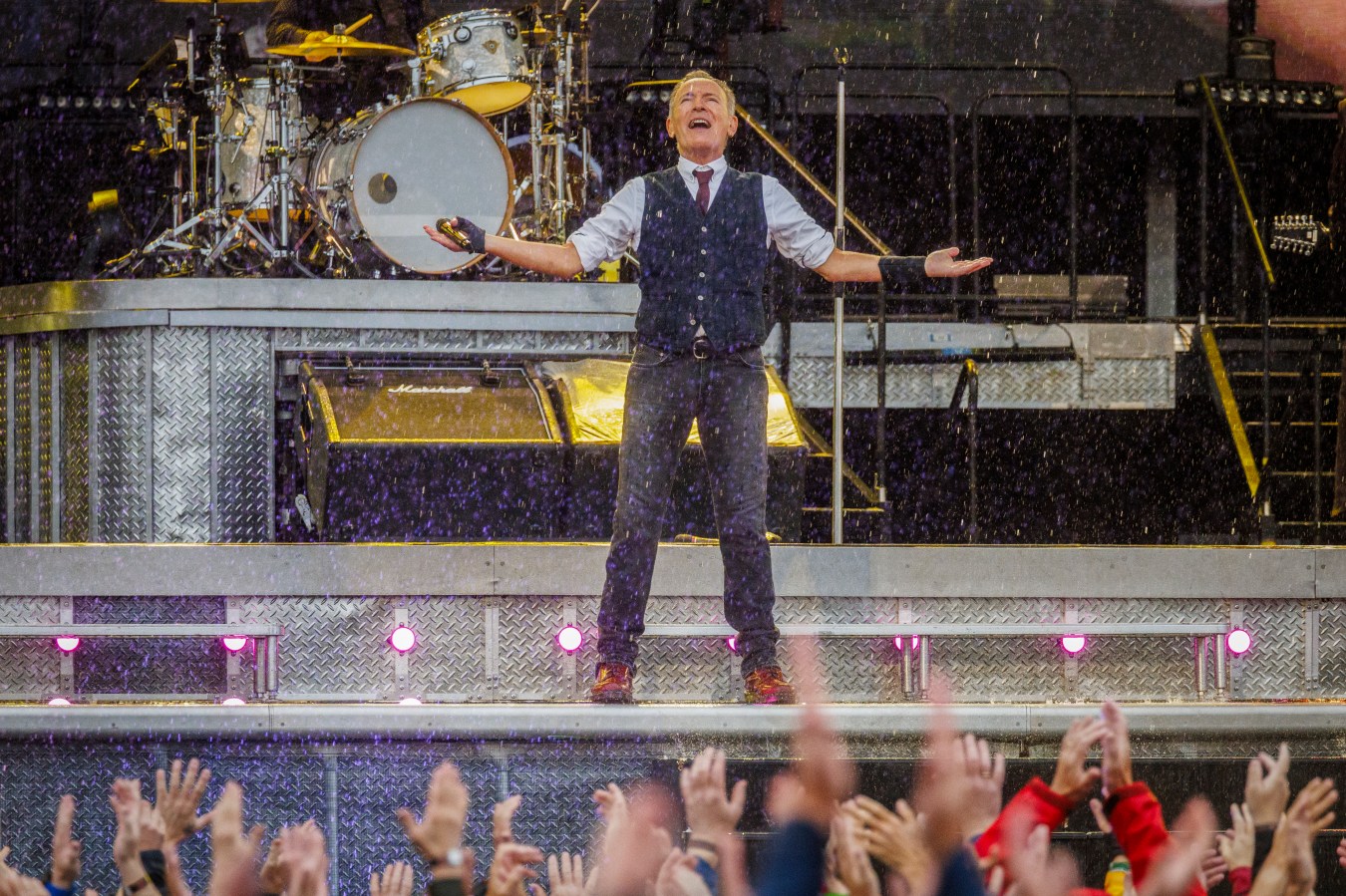

A big TV advertising blitz in the U.S. has fueled Temu’s growth, including ads during the 2023 and 2024 Super Bowls that encouraged Americans to “shop like a billionaire.” New survey data released last month from YouGov shows that nearly all Americans surveyed said they had heard of the company.

Temu package in apartment building lobby, Temu, which is owned by Chinese parent company PDD Holdings, shopping app Temu.com, Queens, New York.

UCG/Universal Images Group via Getty Images

Its parent company PDD Holdings, which also owns an enormous sister online merchant site called Pinduoduo that only operates in China, is worth more than $167 billion. PDD Holdings is technically based in the Cayman Islands. The company has over 17,000 employees worldwide, according to its most recent annual report, the overwhelming majority of which are believed to be working in China.

Last month, PDD Holdings announced record annual profits of over $8.4 billion in 2023, which includes approximately $5 billion in net income attributed to “other subsidiaries of PDD Holdings,” a group that includes Temu. That’s nearly twice as much as the $3.4 billion in profits brought in by the Chinese arm of the company.Shein is valued at $66 billion according to CNBC, has been rapidly encroaching into the territory of American fashion brands like Gap and Macy’s. The privately-held company has also grown incredibly fast, going from an approximated $2.5 in revenue in 2019 to an estimated $48 billion this year, according to ECDB, a German e-commerce analytics firm.

Both companies, which are likely to surpass revenues of $90 billion this year, stand to have a record-breaking holiday season — and shippers are already concerned.

“The fact that we are talking about this kind of a market this early in the year is leading a lot of people to thinking how challenging peak season, Q4, will be,” Brian Bourke, chief commercial officer of SEKO logistics, told Forbes.

“If we are like this now and it’s early May, imagine what it will be in September, October, November and December?”

This story was first published on forbes.com and all figures are in USD.