Snapchat founders lose billions after ‘violent’ 35% stock crash

Snap stock’s “violent” 35% crash Wednesday was the third-worst daily drop in Snap’s history.

Snap stock’s “violent” 35% crash Wednesday was the third-worst daily drop in Snap’s history.

Tesla has lost $210 billion of market value in 2024 while Eli Lilly gained $140 billion, as investors trade ditch their EV optimism for the GLP-1 craze.

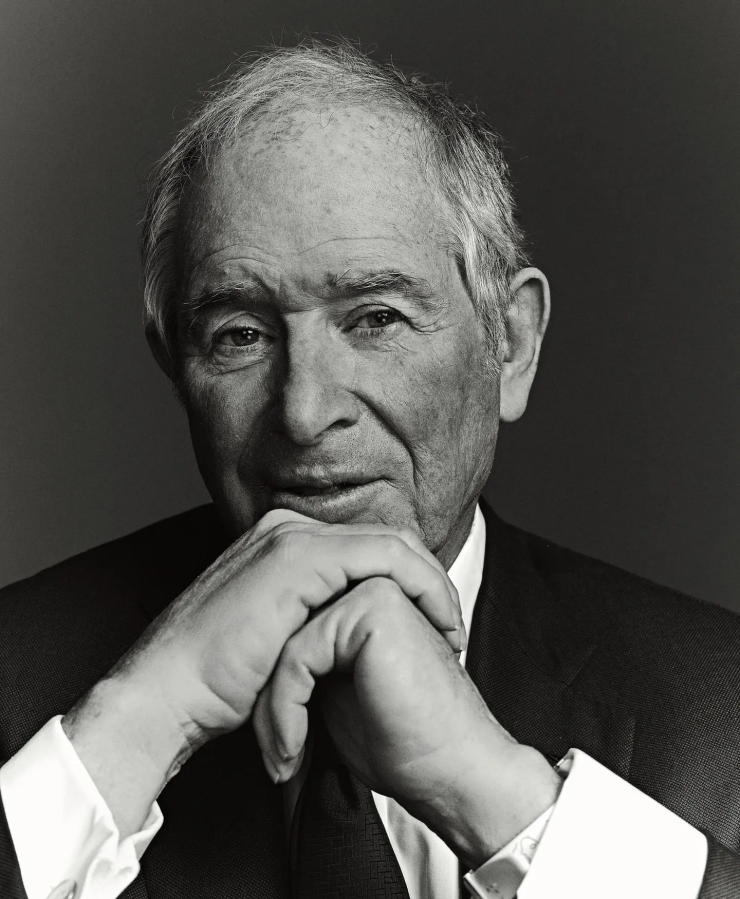

With $1 trillion in assets and unrivaled returns, the private equity giant has conquered Wall Street, but its 76-year old founder, Steve Schwarzman, isn’t finished. He wants total domination overseas as well— and the firm’s crown prince, Jonathan Gray, has built an ingenious weapon targeting vast amounts of global wealth.

Uninspiring earnings and a “black cloud” from Elon Musk drama have sent Tesla shares down 27% in 2024.

Start-up funding in 2023 was similar to COVID levels, topping just $3.5 billion compared to $7.4 billion in 2022, the latest State of Australian Startup Funding Report found.

The social media company joins Microsoft, Zoom, Okta and others that have laid employees off in the new year.

Never mind the recent rally, for a decade the crypto industry has been selling the promise of decentralisation, a new financial system without middlemen, but many blockchain projects have recreated the very elements they tried to overthrow, and regulators are adamant about keeping the status quo.

But Apple (shares down 5% this year) and Tesla (down 26%) have watched on the sidelines as their big tech peers have won over investors in 2024.

The company is attempting to sell most of its remaining stock of Yeezy footwear at cost, instead of writing it off.

Last January, PayPal laid off some 2,000 people.