Shares of Meta and Amazon skyrocketed Friday to multiyear highs after the technology giants each reported blowout earnings, capping the firms’ dramatic recoveries from their 2022 nadirs as some of their big tech stock peers have been relegated to the sidelines.

Mark Zuckerberg is billions of dollars richer after his company reported strong earnings.

AFP via Getty Images

Key Takeaways

- Meta stock jumped more than 20% to a new record closing share price of $474.99 on Friday, notching its largest single-day gain since July 2013 as investors digested the social media company’s Thursday afternoon earnings report featuring revenue and profit beats and debuting the company’s first-ever cash dividend payments to shareholders.

- Amazon’s comparatively meager 8% jump to over $170, its highest split-adjusted price since December 2021, came after it reported similarly strong quarterly results and provided guidance above expectations.

- Shares of Meta and Amazon are now 31% and 12% year-to-date, respectively, according to FactSet.

Forbes Valuations

Meta and Amazon’s billionaire founders grew far richer Friday as their respective companies’ stocks swelled. Amazon founder and chairman Jeff Bezos’ net worth grew $12 billion to $194 billion, according to our real-time estimates, placing him just $5 billion behind Elon Musk for the mantle of the richest American. Meta CEO Mark Zuckerberg’s fortune jumped $28 billion to $167 billion, vaulting him past Oracle CEO Larry Ellison to become the world’s fourth-richest person.

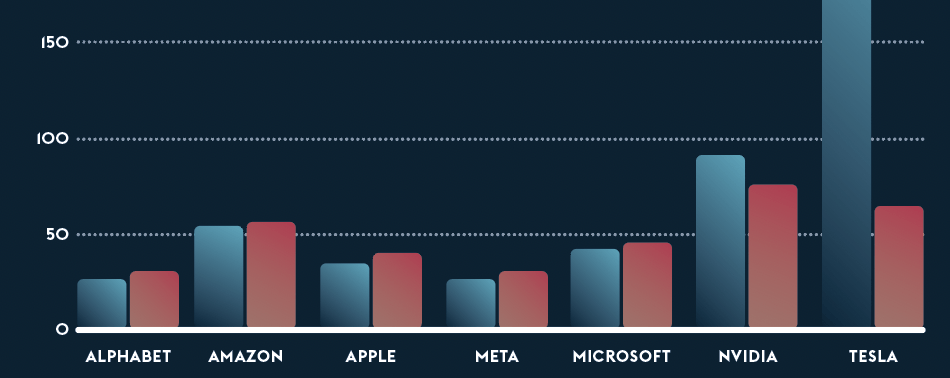

Contra

It wasn’t all sunshine for big tech stocks Friday. Shares of Apple sank 2% after the company’s own earnings report Thursday failed to impress Wall Street due in large part to weak sales in China, extending the iPhone maker’s year-to-date stock losses to 4%. Apple’s “sluggish growth” compared to its big tech peers is weighing on its stock price in the near term, Bernstein analyst Toni Sacconaghi explained in a note to clients. Also declining Friday were shares of Google parent Alphabet (down 2%) and Tesla (down 3%), signifying the split in the “magnificent seven” stocks who drove 2023’s broad market gains. Among those seven leading stocks, Nvidia (up 34%), Meta (up 31%), Amazon (up 12%) and Microsoft (up 9%) have gained year-to-date, while Alphabet (down 1%), Apple (down 5%) and Tesla (down 26%) have slid. Each of those stocks rose at least 30% in 2023, outperforming the S&P 500.

This article was first published on forbes.com and all figures are in USD.