There’s a new bucket of VC money in town, but the cash from Main Sequence’s Fund 3 won’t be going to any old start-up.

Key Takeaways

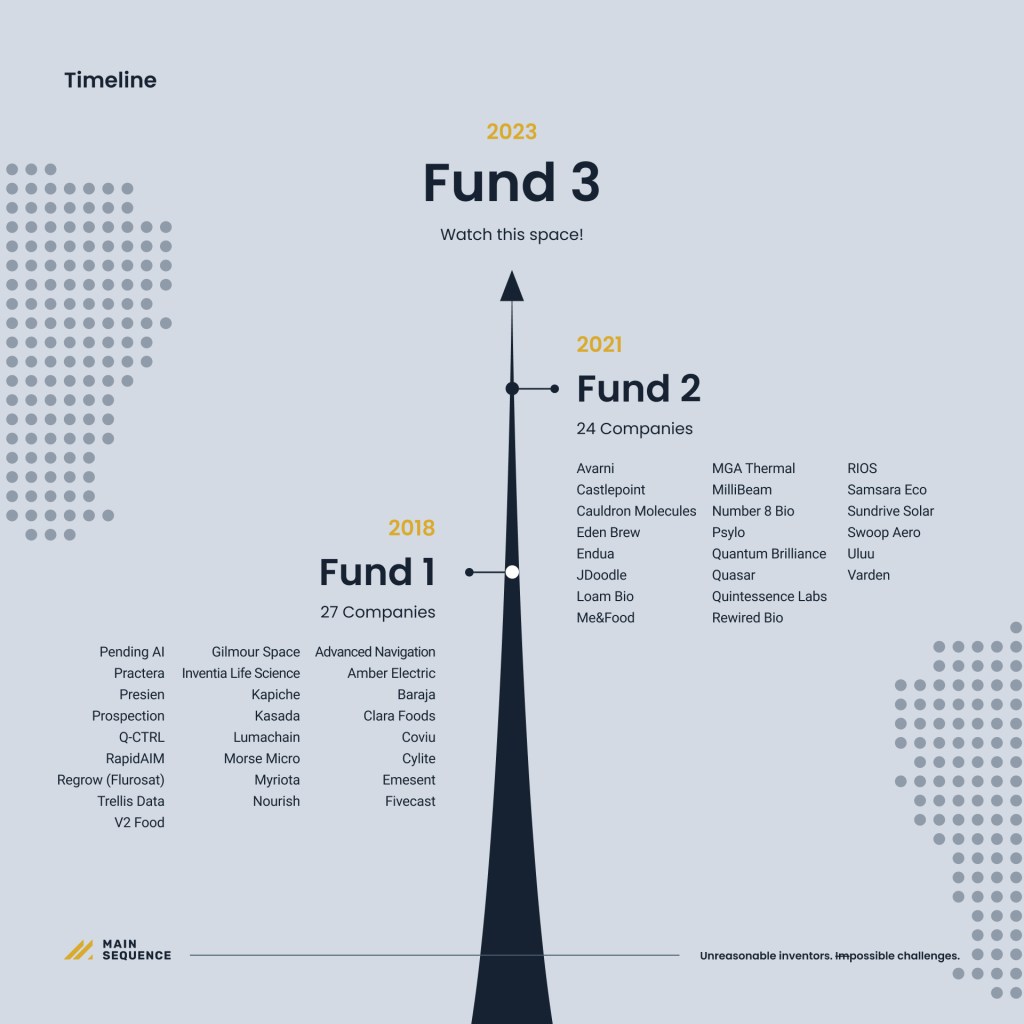

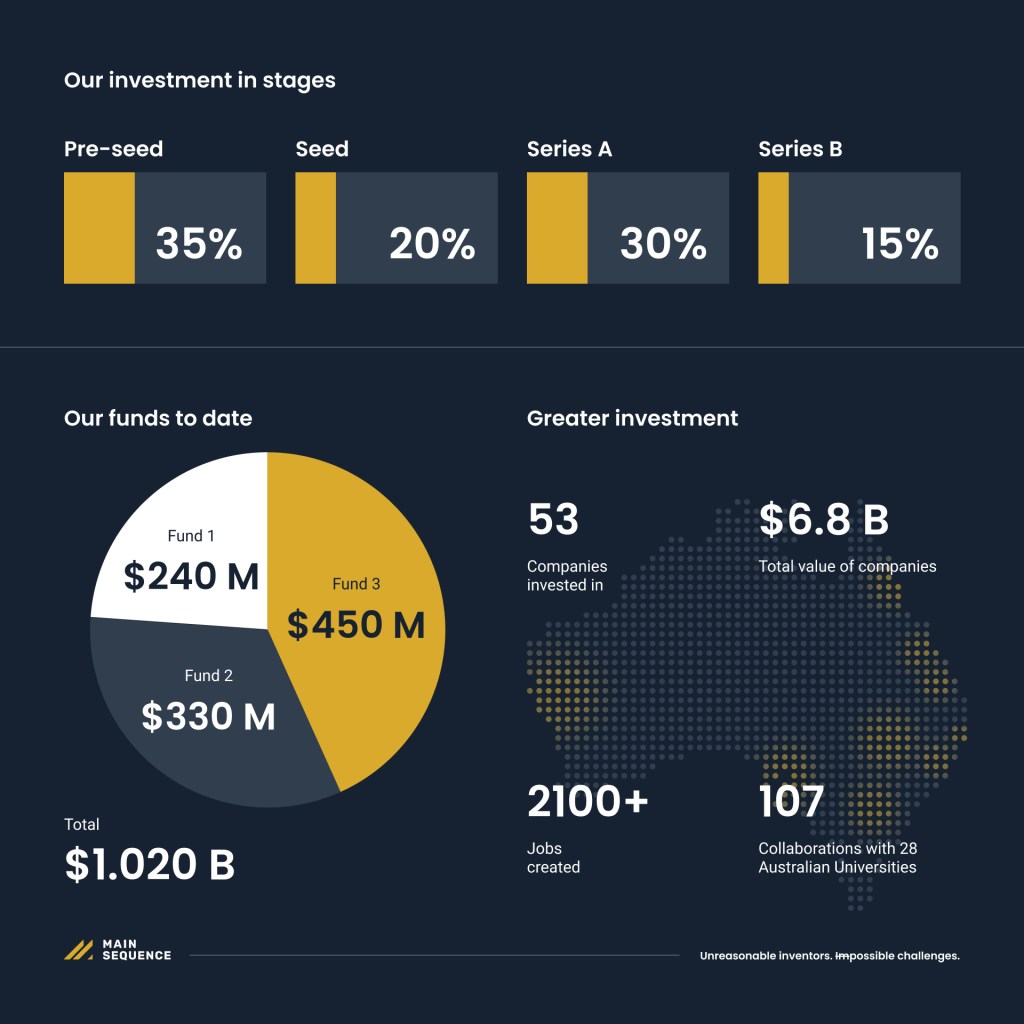

- Deep-tech investor fund Main Sequence has closed its third fund at $450 million, taking the VC’s total dollars under management to $1 billion.

- Main Sequence, founded by CSIRO in 2017, says the new money makes it the largest dedicated deep-tech fund in Asia and perhaps in the top five globally.

- New investors include Daiwa Securities Group, The Grantham Foundation and LGT Crestone. Returning backers include Morgan Stanley Wealth Management and Temasek. Plus $75 million from the federal Australia’s Economic Accelerator program.

- Main Sequence has backed 53 companies which have created 2,100 jobs and have grown to a market value of $6.8 billion.

- Portfolio companies include Regrow, Advanced Navigation, Q-CTRL, Morse Micro and Samsara Eco.

- Main Sequence’s first fund closed at $240 million in 2018 and the second at $330 million in 2021.

- Fund 3 is pursuing two imperatives: decarbonisation and “advancing critical technologies central to Australia’s national interest” which includes cybersecurity; quantum computing; and advanced semiconductor technology.

“If you could build it in a weekend in your garage, it’s probably not something we’re investing in,” says Mike Zimmerman, co-founder of the “deep-tech” venture fund. “The companies we’re investing in are solving very concrete problems, like safety on construction sites, or in mining, or digitally mapping the underwater world, or creating a way to make an infinitely recyclable bottle.

Main Sequence was initiated by the CSIRO in 2017 to “bridge the valley of death” between publicly funded inventions and their commercialisation. The federal science and industrial research organisation used $70 million of federal government money and $30 million of the $430 million it made from the invention of wi-fi, much of which it had recently clawed back in a series of court cases more than a decade ago.

“Those are not things you’re gonna get in the app store.”

Mike Zimmerman, Main Sequence

The new money will go to about 25 companies that will be chosen over the next three years, says Zimmerman. “They have to be powered by world leading research, and then they have to have the potential to be able to scale to be worth hundreds of millions of dollars over time, and have a global impact, and then be originated out of the world leading research that’s done down here.”

Zimmerman anticipates they will go through thousands of ideas and only about one in 100 pitches will be successful. “As an example, the other day we went to Sydney University’s Centre for Field Robotics which is a wonderful place, but they would have like 50 different projects going on there. We meet with people and learn about all those ideas. I think if you counted all the ideas, then it would probably be 1000 to one.”

Main Sequence partner Gabrielle Munzer cited the launch of “venture science” start-ups Endua, Eden Brew, Quasar Sat, Cauldron, and Samsara Eco as success stories of Fund 2. “We are keeping up this momentum with Fund 3, pioneering new frontiers in biotechnology and plan to continue co-founding new companies at the bleeding edge of exciting advances in food and fibres,” Munzer said.

Because it concentrates on deep-tech, Main Sequence’s investments can take a little longer to scale than others, says Zimmerman. “But we’d like to think that the impact is going to be very substantial as well. And, importantly, we’re not doing anything for impact just in Australia. It’s more about taking Australian innovation and taking that out to the world.

“It’s maybe a little cute, but we call them ‘planetary challenges’ … They have to be planetary in scale for us to get excited about ’em.”

While it is CSIRO-backed, Main Sequence will invest in any innovation arising out of publicly funded research from universities or applied scientific organisation like the Cotton Research and Development Corp. The federal scientific organisation will step in, though, to help the start-ups connect with world leading research in their fields and apply it.

“And that gives the company some kind of defensible advantage and help them compete on a global scale and grow faster.

“The partnership with government – even though it’s a little bit unusual for a fund that’s trying to deliver financial returns – is something that gives us what we like to think of as like a bit of an unfair advantage.”

Mike Zimmerman, co-founder Main Sequence

Zimmerman does not nominate the funds’ hit rate to date, beyond saying that “a couple of odd companies” out of the 53 it has funded had gone out of business. “But for the most part, I’d say we’ve been relatively fortunate in that we haven’t been beset with tons of failures yet. I’m sure those will inevitably come over time, especially in the difficult environment that we’re in now, for funding.”

Investors include: Hostplus, LGT Crestone, Morgan Stanley Wealth Management, NGS Super, Australian Ethical Investment, Daiwa Securities Group and The Grantham Foundation.

“The fund also includes the first half of the committed $150 million CSIRO investment announced as stage three of the federal government’s Australia’s Economic Accelerator program,” Main Sequence said in a statement. “It comes as Main Sequence backs and builds companies that reflect Australia’s national priorities investing in ideas that will diversify and transform Australia’s industry and economy.”

Main Sequence’s largest total raisings

| Company | Funding | Funding Round | Date | Description |

| Morse Micro | $140 million | Series B | September 2022 | Designed Wi-Fi chips for reliable long-distance connections, ideal for smart home and industrial devices. |

| Advanced Navigation | $108 million | Series B | November 2022 | Specializes in AI robotics and navigation technologies. |

| Loam Bio | $105 million | Series B | February 2023 | Develops carbon sequestration on farms using soil microbes. |

| Q-CTRL | $76 million | Series B | January 2023 | Provides quantum computing infrastructure software. |

| Samsara Eco | $54 million | Series A | November 2022 | Aims to build an “infinitely recyclable” plastic bottle. |

| Regrow Ag | $50 million | Series B | May 2022 | Utilizes satellite imagery to help farmers implement regenerative practices. |