Stewart Hawkins spoke to Equity Trustees managing director, Mick O’Brien – a seasoned finance professional – about how you play the long game, build and protect wealth in tumultuous times and the advantages actual income can have over unrealised capital gains.

This story is featured in Issue 18 of Forbes Australia. Tap here to secure your copy.

What were your fundamentals before we got into this crazy post-COVID world?

The normal sorts of things you would expect, sound diversification depending on the liability profile of your clients. It’s also we have a lot of regard for where our return is coming from, whether it’s from capital appreciation or whether it’s from income.

It’s actually not a bad way of investing because an income return, you’ve got it in your hand, a capital return until you realise that, you don’t have it – but it’s not the way most funds managers

would think.

Our principles are embedded with a long-term view of what’s happening in the world and doing a lot of work to make decisions. We’re not fast in and out traders, but it’s certainly not set and forget either the world’s changing dramatically all the time.

What is the difference before and after the COVID crash of 2020?

When you go back to that time, the uncertainty was incredible. You can see supply chains were going to be incredibly disrupted. You can see that trade was going to be materially negatively impacted. You can just generally see there was going to be a lower growth environment for a good period, and that’s what’s transpired but would then the world be able to move [its] way out of that?

To some extent, the world did move out according to the expectations of a lot of investors [but] now if you look at where we are today, we’re in a fairly normal [interest rate] setting. It’s benign.

It’s not out of control. We’re not on some incredible tightening cycle. We don’t have those historic lows that implied a very low growth environment over a long period. We are back into a normal cycle of interest rates and inflation.

Of course, we’re not in a normal world cycle in terms of the economics of the world and the stability of the world. There’s probably more conflict than we’ve had in a long, long time. There’s a lot of the uncertainty of the tariffs and the chopping and changing of that. No one can really predict how that’s going to play out, so you’ve got to be agile and active with that. But to some extent, there’s pressure on the world order between the US and China and, to a lesser extent, Europe. So that’s creating challenges, but also opportunities.

From the Australian perspective, we’ve got a major energy transition going on, and that is causing opportunities and challenges.

“You’ve got to look at the Australian equity market and, well, it’s not a great market.”

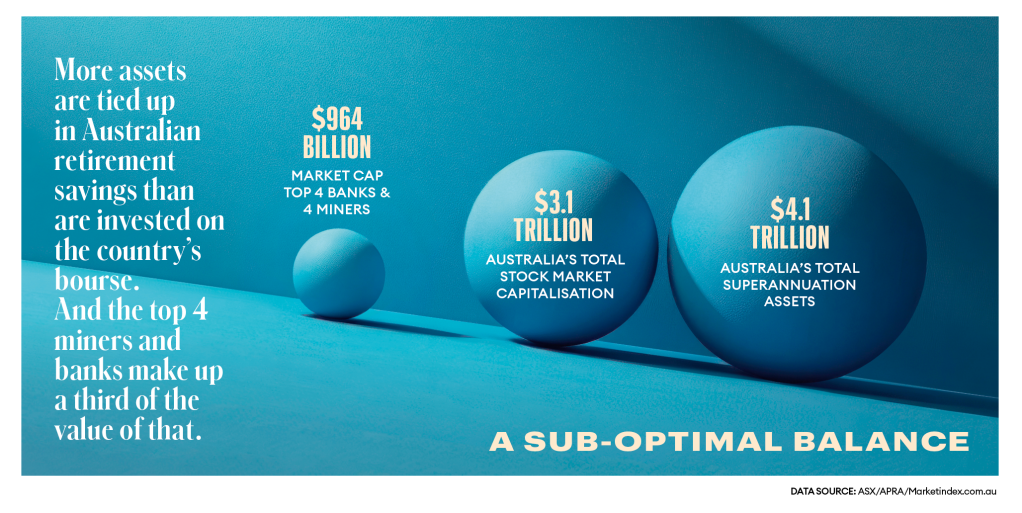

It’s a $3 trillion market, and the top eight stocks, the four banks and the four big miners, they are $1 trillion of the market effectively. That’s not normal and probably not the way you want to invest your money long term. You’re pretty exposed to particular sectors.

What we’ve seen going on in Australia, probably almost for 20 years, is this shift away from investing in domestic asset classes, Australian bonds and Australian equities, Australian real estate, to investing on a global basis, global equities and global fixed income and global real estate and infrastructure.

I think that will continue because, one, our market isn’t diversified enough, but, two, the mandated growth in the superannuation assets. We’ve got super assets sitting out at $4 trillion – they’re bigger than the whole size of the Australian stock market.

But you need to consider franking issues and currency fluctuations with offshore investing?

Yeah. You do. The reality is most Australian investors tend to take that punt and not hedge it out. They might hedge it out on fixed income and real estate, but they won’t hedge it out on equities. That’s helped them in the past year as the Australian dollar has fallen.

But it won’t always be that. It can create quite a bit of volatility into your return profile. That then says to some extent that what you’re really trying to guard against is Australian inflation, and you can’t really find a proxy offshore that relates to Australian inflation. It doesn’t quite work like that. So, you’re running the risk basically if you’re investing offshore, that you may not match our inflation profile.

What does this “new normal” mean?

It’s made fixed-income asset classes more attractive because they have fundamentally now at a risk-free rate, if you like, the RBA’s rate or the government bonds rate. There’s a return there and it’s in excess of inflation at the moment. Then you add on other credit and alpha opportunities to it, you’re starting to get quite meaningful returns. It was not an asset class you could invest

in five years ago, but now you can get into private credit and be getting six, seven, eights, maybe nines [percentages] in some of these spaces.

There’s risk with it, but that’s not a bad return.

We’ve seen massive demand for private credit, and I think ASIC’s been doing some investigations and thematic reviews in this area. They’re particularly focused on real estate development credit, as they should, because there are some very successful fund managers in that space and a lot of money has been raised. That can be quite a risky part of the credit space.

The other area where we’re seeing massive demand is for global private credit and portfolios that are built in considerably more diversified ways across a whole range of different types of credit instruments from multiple industries, multiple countries and issuers. It doesn’t mean they can’t have a problem, because often when there is a problem, all credit goes down. But, generally you’re going to bounce back reasonably if you diversify across all the sectors.

The other pervasive trend that’s happening in Australia is that the superannuation members are starting to get to the retirement phase. Sure, you can use asset classes and just sell assets as you want to get your income, but it’s way better to have an investment program that is actually producing you your income, and you don’t have to sell your assets.

They are increasingly attracted to these types of investments that might be producing them 7, 8% per annum. They’re not having to sit there and think, ‘what am I going to sell this year for my return to get my actual liquidity?’

There is a part of the market that have got excessive superannuation funding and they’re not going to utilize all their capital, and it will end up going to the next generation.

Looking at stock valuations – they’re not “normal” particularly amongst stocks like CBA.

What’s happening there?

There’s a debate going on. CommBank is close to, if not the most highly valued bank in the world.

Some people would say, well, isn’t that fair enough? I mean they’re the clear leader.

They’ve got the number one brand. It’s more exposed to retail, a lot less risky. Why can’t they be, right?

But the Australian market’s never going to be the highest growth economy in the world, so they’re operating in our Australian market and that’s it. I think the argument is basically, no, it’s not justified. As good as they are, it’s not justified that they’re the most expensive bank in the world. They still probably represent a relatively safe long-term investment, but there’s not a lot of upside from where we are.

That’s the issue. You invest in the Australian market and you’ve got the four banks, and then you’ve got the top four mining companies. This takes a trillion dollars. It’s a third of the market in those eight stocks. So that wouldn’t be how you’d normally set up a diversified portfolio.

Of course the mining stocks, well, they’re subject to their own cyclical volatility,

and it’s not exactly an upside scenario for most of them at the moment.

So, having said that, there’s some other incredible companies there in the ASX, and they’re not… I know some of them you’d say, no, they’re not overpriced. Some of them have been hurt by the tariffs, like CSL and ResMed. It doesn’t mean they’re not one of the best companies this country’s produced. Some of the others, ResMed’s probably in the same category when you look at it. So there are some great companies in there that I would say are not overvalued at this time. You have reasonable long-term investments. You have market leaders in their particular sector.

So Aristocrat, ResMed, CSL, these are all market leaders in their sectors, global leaders.

The other thing I’d just say is that investing in Australian equities, you’re not going to get a lot of exposure to technology and you’re not going to get a lot of exposure to health pharmaceuticals. You’ve got to look elsewhere to get that.

I’ve got to keep coming back to: where’s the volatility in this situation?

Yeah, it’s failed.

I guess the first thing is that the investment markets don’t follow exactly the economy or the political world order. When I say they don’t follow it exactly, there’s timing delays. Markets are generally moving ahead and so on but long term they do. The volatility is not up there at the moment, but I guess it’s now obviously playing out of the tariff issue.

Now there’s some talk about copper and pharmaceuticals and so on. Well, what’s in pharmaceuticals? Which copper stocks are going to [be] impacted and so on? But that may not go ahead.

Do you jump at shadows, or do you wait to see some of this actually be locked in?

That’s a little late, but you could also be left jumping at a lot of shadows and creating volatility in your own portfolio by buying and selling, chopping and changing, shifting around, and then the decisions get reversed or worked out. So, it could have a lot of trading costs.

I think a lot of investors, from our point of view as a long-term investor, will sit and watch and wait for it to unfold a little more clearly before making significant portfolio changes to reflect that.

Where does it become so dangerous that as a long investor, you have to act? Hypothetically, what would need to happen for you to say, okay, all right, we just can’t sit this out?

It could be a significant escalation of the military conflicts that are going on. That’s one thing. These tariffs really curtail global trade, create inflation. You want to protect your capital and you make an asset allocation shift out of equities and more into fixed income, and you focus in on the income-producing ability of your portfolio.

A lot of people are oblivious to whether a return is income or realised capital gain, but we can’t be oblivious to that. Income is less risky because you’ve got it. Unrealised capital gains [are] on a piece of paper.

We would shift further that way if we could in a volatile situation but we’re not going to completely throw out our investing structure and asset allocation ranges. It’d have to be dramatic for us to be rethinking those, because those are things that we have embedded over the long-term and we think they’re balanced in the right way.

As a long investor, what are your thoughts on where fixed income is headed?

I think there is a long-term trend going on that lending is shifting away from the banking sector to the non-banking sector. It’s not that far advanced in Australia, but it certainly is in the US, and I think that’ll continue. That’s a function of the regulation in putting higher capital requirements

on the banks and, therefore, other parties coming into that mix and saying, well, that’s too high and, therefore, we can provide the lending and other investors can take the risk rather than a bank’s capital balance sheet and its shareholders. So, if you don’t get it right, then others will provide the lending.

That’s happening, say, in the Australian real estate development market at the moment. Most of this Australian real estate development that’s going on large scale is not being linked to by the banks. They have in fact almost exited the space because the capital requirements are too high. But, therefore, you’ve found other investors who are willing to lend, invest in these types of propositions, and not expect the same return as what the bank would be if they’re underwriting the loans.

I think we’re going to continue to see that trend of an increase in the non-bank lending market and, therefore, continue to see larger scale, more diversification in private credit around the world.

There’s so much noise in the market about AI, how do you approach that sector as a long investor?

Everyone can see the significant power that is available, and [how] it could be utilised and harnessed is still unclear for many players.

There’ll be the winners who are actually, if you like, monetising AI as a service proposition and providing it the capability but I think the more basic impact across companies will be how normal companies use AI and how quickly can they capitalise on and become more efficient?

I don’t think it’s going to replace all humans. That’s not going to happen.

I think the other way we think about it is AI may not be perfect, but if it gets us 80% or the 90% of the job done and then we step in with humans and complete it, then that is a fantastic position.

What keeps you awake at night?

One of the things is if the markets do fall dramatically and suddenly, I guess there’s two things there. Equitable treatment of investors in that scenario is very important, and that’s what we spend a lot of our time doing. The investors who exit or stay or come in are all being treated equitably on the right valuations. That’s important.

And people getting advice and not overreacting and making the wrong decision at exactly the wrong time. You can’t always stop that happening.

And obviously the world turmoil, military turmoil that’s going on is… I feel that it’s taking [us] back to the ’60s.

What’s your final word?

Be educated about what’s happening. Don’t invest in anything that you don’t understand. Always retain a diversified approach. There’s no person that’s brilliant enough to not diversify and just pick winners all the time.

This article represents the views only of the subject and should not be regarded as the provision of advice of any nature from Forbes Australia. The article is intended to provide general information only and does not take into account your individual objectives, financial situation or needs. Past performance is not necessarily indicative of future performance. You should seek independent financial and tax advice before making any decision based on this information, the views or information expressed in this article.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.