From fight nights to a $2-billion business, Luke Anear shares some of his insights.

SafetyCulture founder Luke Anear says the federal government has been in contact with him about the potential to change auditing requirements for large private companies.

Anear threatened to domicile SafetyCulture – valued at more than $2 billion based on a 2021 capital raising – in the US because of what he said was an unfair headline based on a $61 million loss compulsorily reported to the Australian Securities and Investments Commission.

“The reason it pissed me off is because if you were going to get scrutinised and written up in the press based on every mistake you make – and most of the stuff we do doesn’t work, but the stuff that does work makes up for it – then you innovate less. You take less risk,” Annear told the Forbes Australia Business Summit 2022 on Friday.

“That’s why professional CEOs who have to work to quarterly or six-monthly reporting periods will not take the same risks as founders will, or private companies. That’s the cost we’re talking about. We’re saying, ‘Do we want to encourage people to keep taking risks – providing they’re being responsible and meeting the agreements they’ve got with their investors who have access to all the information.

“The government’s reached out to us, saying they want to look to change this, so let’s see what happens.”

While most Australian private companies have no obligation to report their financials to ASIC, larger ones do if they fit two of the following criteria: employ more than 100 people; turn over more than $50 million; or hold assets worth more than $25 million. The rules were introduced by the Keating government to make large private firms more accountable.

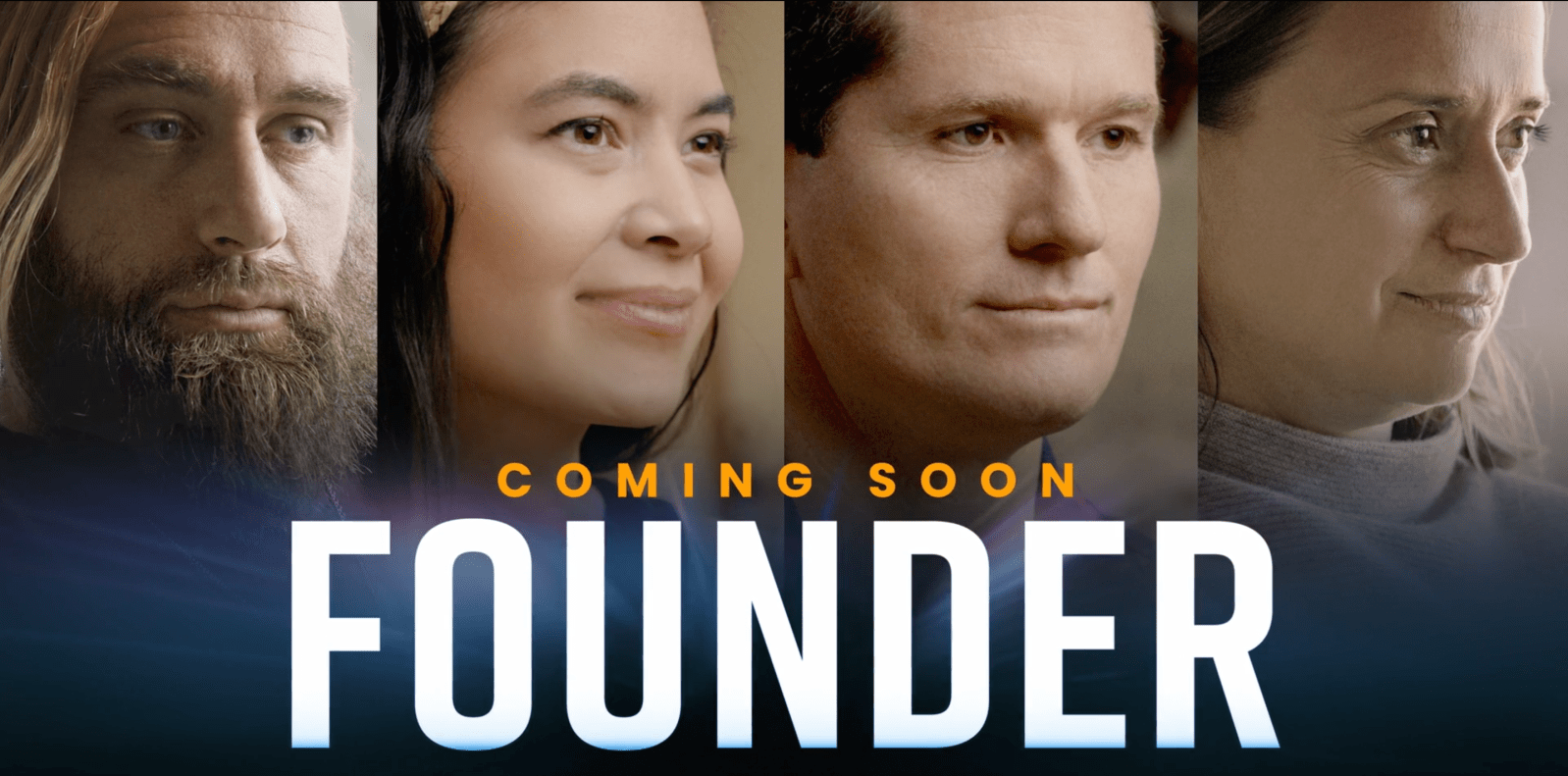

In a wide-ranging talk at the Business Summit with Forbes Australia editor-in-chief Sarah O’Carroll, Anear spoke of how he’d been prompted by motivational speaker Tony Robbins to write down a goal. He’d chosen a “crazy” dream: to make $40,000 a month. It prompted him to mount his first entrepreneurial venture – a no-rules fight night.

He quit his job as a trainee private eye and took off to Darwin where he lived in his car for a month while organising the fight. One thousand five hundred and nine punters turned up, he recalled, and he made a $42,600 profit. “That experience has served me more than any other. That I can walk out this door with nothing but my clothes, and I could figure it out … We’re all capable of so much more than we realise.”

He went from that fight night with no rules to building a billion-dollar business, SafetyCulture, based on checklists and strict adherence to long lists of rules. But he maintained that rules on the reporting of results weren’t a good fit for building modern app-based business.

“With venture capital, it’s a matter of, ‘We’ll give you some money. You go and capture a market. Go and build great products, get lots of people using it, then we’ll monetise that over time.’

“When we launched iAuditor, it was a free app. There was no way to monetise it. Then the first way we got money was from a $7 one-time payment for a feature unlock, and Apple took 30% of that …

“Then we had companies saying, ‘We inspect our airline in South America with your app and we’ve just lost three devices that had all the inspections on them that we need to give to the regulator. Where’s it all being backed up?’

“We were two guys in a garage in Townsville saying it’s not being backed up anywhere. We’d better build a cloud. I said to Al, ‘Who do you know that can build a cloud?’

“He said, ‘I don’t know. Tristan’s pretty clever.’ So we got Tristan in, and Tristan built a cloud and we charged $5 a month for it. That was like 2012-13. We had to hustle and scramble. The point I’m making is the monetisation is actually quite easy if you’ve got lots of customers, lots of people using your product. The hard bit is to get lots of people using it.

“The venture model is one where you say let’s invest. Let’s burn cash and we’ll capture a market. We flip between burning cash and profitability as we need to. At the start of Covid we went from burning $1.4 million a month or something, back to profitable. We’ve done it again now as well. You submit your audited accounts then journos go and get it and they don’t have any idea of what we’re building, what’s coming through. Any of those things. Then they write up this headline, ‘you’ve made this $61 million loss’. Which was true, but it was part of the plan. And part of that loss was equity we’d given to companies we’d bought, so it is value leaving the company. On paper it’s a loss, but it wasn’t cash.”

He clarified that even if SafetyCulture moved its nominal headquarters to the US, that would not affect the 600 employees in Australia.

“It just means that we domicile in the US. Atlassian is domiciled in the US, Canva’s always been Delaware incorporated. We’d redomicile to there, and then you’d only show your Australian revenue and income on your Australian audited accounts. You don’t have to submit them and make them publicly available in the US. That’s what it would mean.

“At the end of the day, less money flows through Australia. We’re an export business. Australia is 47th on the list of innovative countries. We’ve got to create an environment that makes it easier for people to do business.”