Amanda Lacaze has been at the helm of ASX-traded Lynas Rare Earths for a decade. The stock shot up 120% over the last year, amid China/U.S. trade tensions. Now, Lacaze is spearheading the capacity, speed, and certainty of an Australia/U.S. rare earth supply chain.

When it comes to the ties between the U.S. and longtime ally Australia, it is, in part the elements that come from our vast Aussie dirt that bind us together.

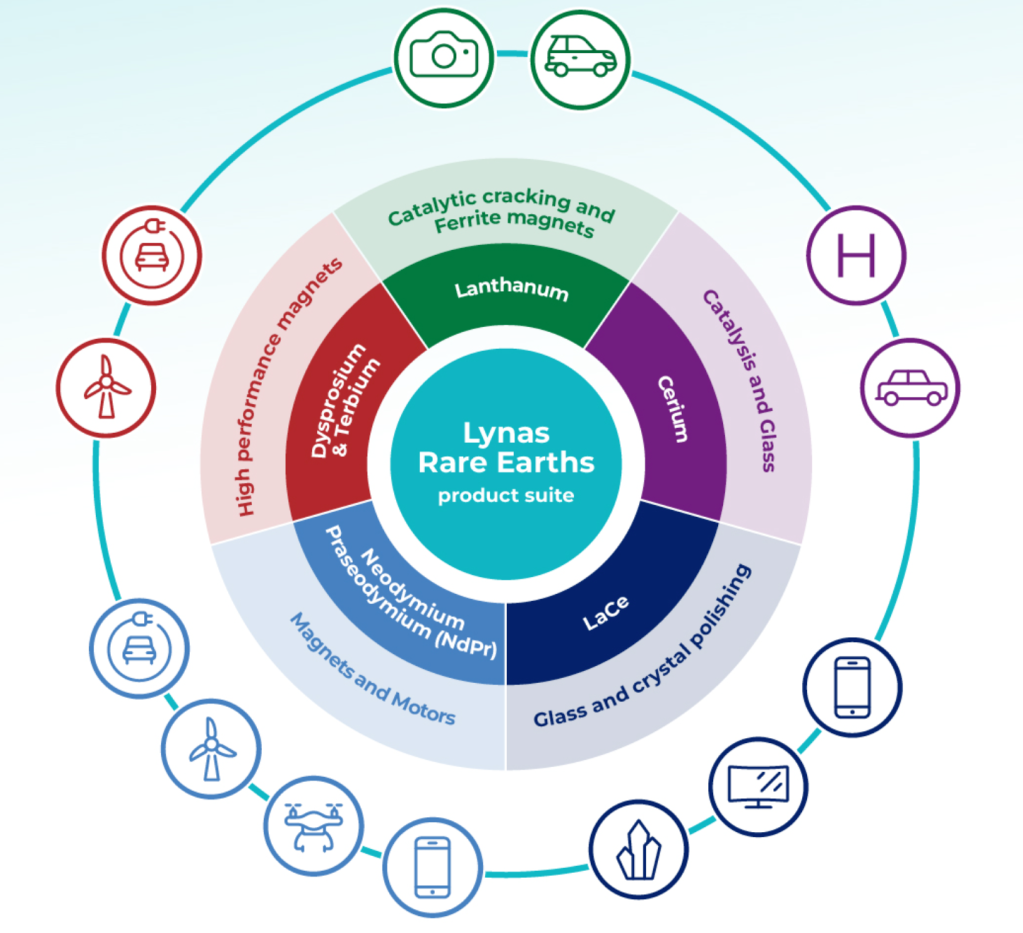

“Lynas is the only outside-China producer able to supply both Light and Heavy Rare Earth products,” Lynas Rare Earths CEO and 2025 Forbes Asia Power Businesswomen, Amanda Lacaze, stated this week.

Officially headquartered in Perth, Lynas was founded in the early 1980s. Its 63-year old Managing Director, Lacaze, was schooled 4000 kilometres away in Queensland.

The rare earth materials extracted from the WA ground – described by the company as ‘the ‘’vitamins’’ of manufacturing due to their special properties’ – are sent to Malaysia, where Lacaze now resides, to be processed in the Lynas-owned facility which is the largest of its kind on earth.

From there, the Aussie-derived magnetic, electrical, optical and catalytic materials end up in electronics, wind turbines, and hybrid/electric vehicles in Asia, Europe and the U.S.

“Market demand for Heavy Rare Earths is high and Lynas can be selective in where, and at what price, we sell Heavy Rare Earth oxides,” says Lacaze.

Of late, Lacaze is prioritising the United States defence, automotive and industrial sectors to benefit from Australian rare earth materials. Early in October, Lynas announced a partnership with Texas-based Noveon Magnetics to ‘establish a scalable and domestic U.S. supply chain for rare earth permanent magnets.’

The deal is designed to provide the U.S. with a reliable value chain of metal, alloy, and magnet products.

“This collaboration reflects our shared belief that sector-wide alignment and bold, coordinated action and leadership are essential to achieving supply independence,” says Noveon Magnetics CEO Scott Dunn. “The time to act is now, and this partnership delivers what the market and the U.S. government need most: capacity, certainty, and speed.”

U.S./Australian governments critical minerals partnership

Two weeks later, Prime Minister Anthony Albanese and U.S. President Donald Trump announced they had signed a critical minerals partnership.

“Australia is home to much of the periodic table of critical minerals and rare earth metals that are vital for defence and other advanced technologies,” PM Albanese said in a statement. “Cooperation on critical minerals and rare earth supply chains is testament to the trusted partnership between Australia and the United States as strategic defense allies.”

Both countries have committed to invest more than USD$1 billion over the next six months to shore up a USD$8.5 billion pipeline of critical minerals projects. One of the initiatives will ensure gallium – an essential input for defence and semiconductor manufacturing – sourced from Wagerup in Western Australia, will be available to both the U.S. and Japan.

A second project was also announced, in which rare earths phosphate-uranium-thorium will be extracted from a site located 135 kilometres outside Alice Springs in the Northern Territory.

While signing the agreement at the White House in October, U.S. President Trump called the relationship between Australia and the U.S. very strong.

“We’re working on military protection, military ships, vehicles, guns, ammunition, everything. We fought wars together. We’ve been long-term, long-time allies, and, I would say, there’s never been anybody better,” Trump said in a televised press conference.

“In about a year from now, we’ll have so much critical mineral and rare earths, you won’t know what to do with them.”

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.