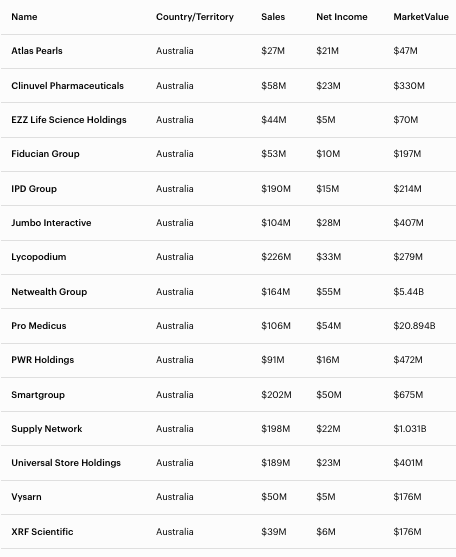

Fifteen Australian firms made it onto Forbes Asia‘s Best Under a Billion list featuring the small – to medium public companies punching above their weight.

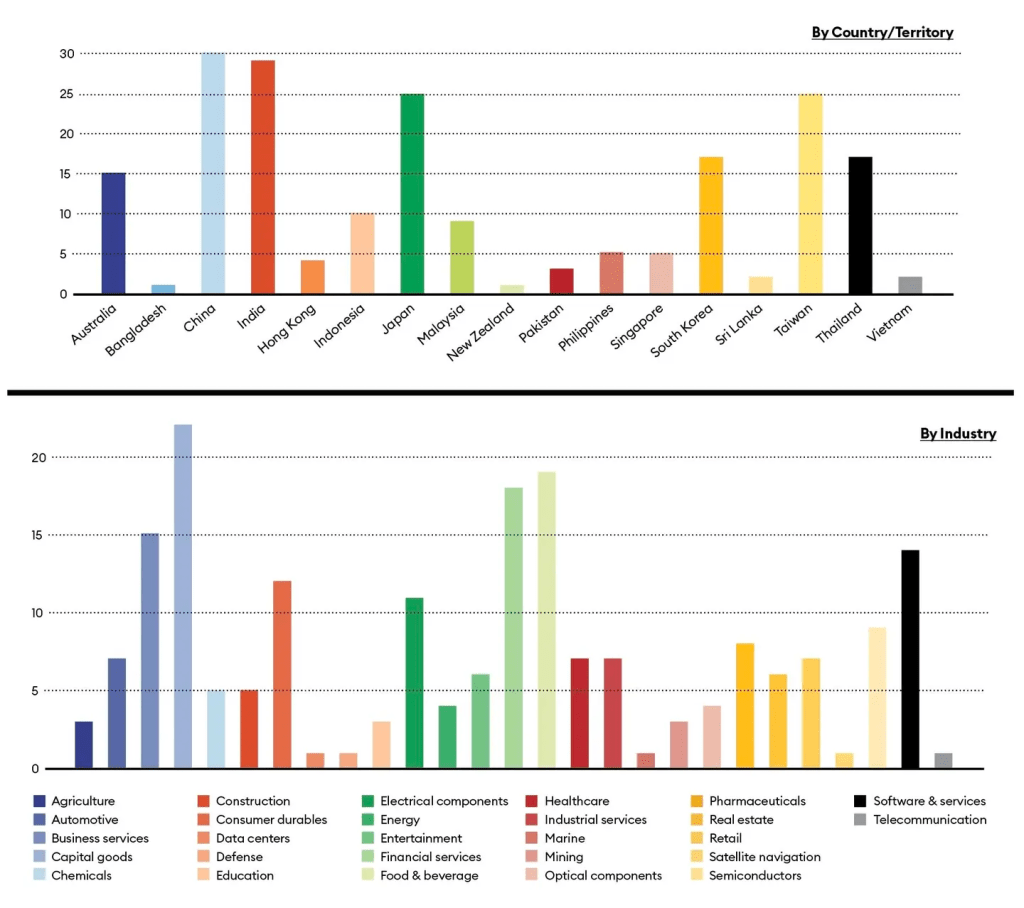

With 15 firms on the list, Australia placed seventh behind China with 30, then India, Japan, Taiwan, South Korea and Thailand.

The Best Under a Billion spotlights 200 publicly listed companies in the Asia-Pacific region with annual sales above US$10 million and below US$1 billion. From a universe of more than 19,000 listed companies, the companies on the unranked list were selected based on a composite score using measures such as debt, sales and earnings-per-share growth over both the most recent fiscal one- and three-year periods, and the strongest one- and five-year average returns on equity.

The most valuable company on the entire Best Under a Billion list was Australian med tech Pro Medicus, with a valuation of US$20.89 billion – some 197 times its revenue.

Pro Medicus’s founders, Anthony Hall and Dr Sam Hupert, surged up the Forbes Australia 50 Richest list this year with personal wealth estimated at US$4.5 billion and US$4.45 billion respectively.

But others on the Best Under a Billion list are not so well known.

Atlas Pearls

Based in Western Australia, Atlas Pearls operates eight pearl farms across Indonesia and has a vertically integrated model—managing everything from hatchery to retail. The company, founded in 1993, has benefitted from the global luxury market’s growing interest in traceable, high-quality pearls.

Clinuvel Pharmaceuticals

Clinuvel is a Melbourne-based biopharmaceutical company best known for its novel treatment for rare skin disorders. Its flagship product, SCENESSE, is approved in several markets to treat erythropoietic protoporphyria (EPP), a condition that causes severe reactions to light. Founded in 1999, Clinuvel continues to explore pigmentation and DNA repair solutions. CEO Dr. Philippe Wolgen has led the company through a long regulatory journey.

EZZ Life Science Holdings

EZZ Life Science was only founded in 2020 in Sydney. It focuses on genomic research and health supplements, targeting areas like longevity, immunity, skincare and gut health. It has leveraged Chinese e-commerce platforms to build a significant export market.

Fiducian Group

Fiducian is a diversified financial services company offering funds management, financial planning, and platform administration. Founded by Indy Singh in 1996, the company manages billions in funds under administration, with proprietary planning tools and software.

IPD Group

IPD Group is an industrial electrical distributor and service provider specialising in circuit protection, automation, and power monitoring systems. The company traces its origins back more than 60 years but has grown rapidly in recent years, driven by infrastructure and renewable energy trends. IPD represents global brands like ABB and offers everything from switchgear to EV chargers. Its customer base includes utilities, contractors, and large-scale industrial firms.

Jumbo Interactive

Jumbo Interactive is a Brisbane-based digital lottery business that operates both government-licensed and charity lotteries. Founded in 1995 by Mike Veverka, the company pivoted from software to lotteries in the early 2000s and now runs OzLotteries.com, one of the leading digital lottery platforms in Australia. Jumbo also provides white-label lottery software to international clients and has expanded into Europe.

Lycopodium

Lycopodium is an engineering and project management consultancy in the resources, infrastructure, and industrial sectors. Headquartered in Perth, the company is known for its work in mining project development, from feasibility studies to construction.

Netwealth Group

Founded in 1999 by Michael Heine and his family, Netwealth is a fintech and wealth management platform known for its sleek user experience and robust investment tools. It offers managed accounts, investment research, and administration for financial advisers and investors. The company sees itself as a financial services disruptor, growing rapidly thanks to the shift toward independent financial advice.

Pro Medicus

A standout Australian tech success, Pro Medicus develops medical imaging software that helps radiologists view and interpret scans more efficiently. Founded in 1983 by Dr. Sam Hupert and Anthony Hall, the Melbourne-based company began as a medical billing and administrative business. It has gained global traction with its Visage Imaging platform. Clients include major hospitals and imaging centres in the US and Europe. Its high-margin software-as-a-service (SaaS) mode has pushed its valuation into the tens of billions, well ahead of revenue.

PWR Holdings

PWR Holdings is a world leader in advanced cooling solutions, particularly for the motorsport industry. Founded by former racer Kees Weel and headquartered on the Gold Coast, PWR supplies custom-built radiators and intercoolers to teams in Formula 1, NASCAR, and Supercars. It also works with the defence and aerospace sectors, applying its thermal management expertise to critical applications.

Smartgroup

Smartgroup provides salary packaging, fleet management, and employee benefits services, largely to government and not-for-profit clients. Headquartered in Sydney, Smartgroup listed on the ASX in 2014 and has since pursued a strategy of organic growth and strategic acquisitions.

Supply Network

Supply Network operates under the name Multispares and specialises in aftermarket parts for commercial vehicles, particularly trucks and buses. Founded in 1986 and now with branches across Australia and New Zealand, the company has grown steadily by serving the maintenance needs of freight and logistics operators.

Universal Store Holdings

Universal Store is a youth-focused fashion retailer catering to 15–34-year-olds with a mix of private labels and curated external brands. Founded in Brisbane in 1999, it now operates more than 80 stores nationwide. The company has successfully integrated online and physical retail, and also owns emerging brands like THRILLS and Perfect Stranger.

Vysarn

Vysarn is a water services company with a core focus on hydrogeological drilling and dewatering for the mining sector, especially in Western Australia. Its client base includes iron ore and lithium miners who need water management solutions. The company emerged in its current form in 2019 after acquiring assets from Ausdrill. Vysarn is capitalising on the resource sector’s increasing focus on sustainable water use and environmental compliance.

XRF Scientific

XRF Scientific manufactures and supplies precision instruments and chemicals used in analytical laboratories, especially in mining, construction, and environmental testing. Based in Perth, the ASX-listed company provides equipment such as fusion machines and crucibles, essential for preparing samples for X-ray fluorescence (XRF) analysis. Its clients include major global laboratories and mining firms.

Australia’s 15 Best Under a Billion