Disney leadership faces a fresh lawsuit from shareholders accusing management of knowingly deceiving investors about the financial health of its core Disney+ streaming service, as frustrations hit a fever pitch with the stock wobbling near a nine-year low.

Disney has faced a myriad of headaches this year.

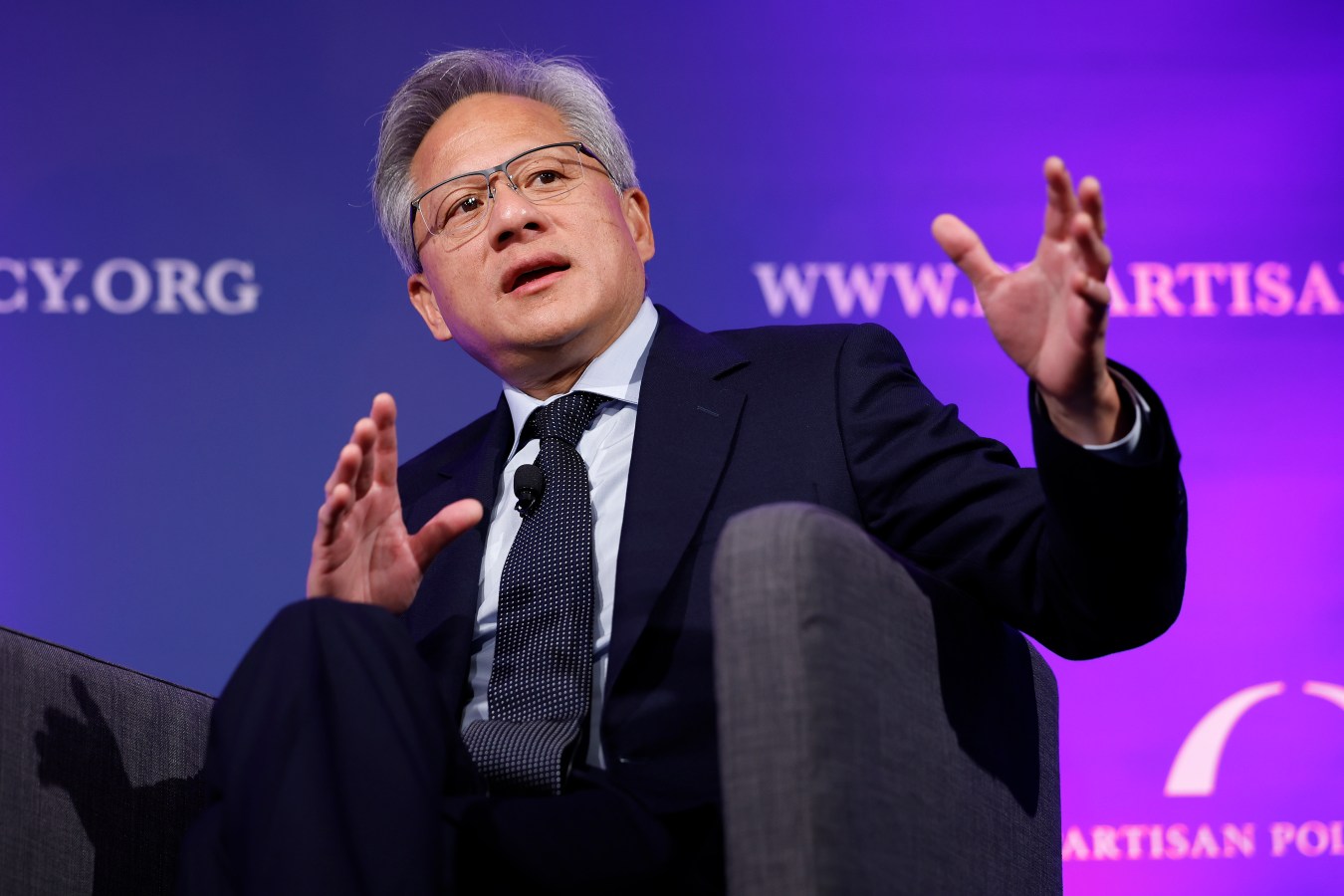

Los Angeles Times via Getty Images

Surprising Fact

Disney stock’s 45% decline since December 2020 makes it the 15th-worst performing stock currently on the S&P 500, per FactSet data, by far trailing the index’s 5% loss over the period.

Related

Big Number

$3.7 billion. That’s how much of a loss Disney reported in the 12-month period ending June 30 in its direct-to-consumer media segment encompassing its Disney+, ESPN+ and Hulu streaming services.

Key Background

The Disney+ suit is the latest headache Disney leadership faces, having staved off a proxy fight from billionaire activist investor Nelson Peltz earlier this year. Among Peltz’s misgivings was an assertion that Disney’s “flawed” streaming strategy and “lack of overall cost discipline” resulted in a subpar return on investment for shareholders. Disney, which now trades at its lowest level since 2014, has posted a 54.5% return over the last 10 years when accounting for dividend payments, compared to a median return of 187% for the 468 current S&P companies who were publicly traded for the entirety of the decade, according to FactSet data.

This article was first published on forbes.com and all figures are in USD.