Qantas Group has posted its first full-year statutory profit after tax since FY19, and claims it plans to share benefits with employees and shareholders.

The airline posted underlying profits before tax of $2.47 billion, and statutory profits after tax of $1.74 billion. It also announced its $1 billion COVID recovery plan was completed and the airline has placed orders for 12 Boeing 787s and 12 Airbus 350s.

The profits are largely in line with the company’s expectations. Net debt, which was expected to be be between $2.7 billion and $2.9 billion, is at $2.89 billion, still well below the initial $3.7 billion to $4.6 billion target range and the FY19 level of $4.7 billion.

The company revealed it has set aside about $340 million to reward its more than 21,000 staff members, including the granting of up to 1,000 Qantas shares (up to a value of $6,000) each, $500 staff travel credit and a $5,000 cash payment to eligible employees as new enterprise agreements are finalised.

The result comes after accumulated statutory losses of $7 billion over the previous three years, and was aided by a 132% increase in flying due to strong travel demand, which drove significantly higher revenue.

Qantas Loyalty, its famous Frequent Flyer program, drove record underlying EBIT of $431 million, and membership across the program increased by 1 million.

“These results show a substantial turnaround in both our finances and service over the past year,” Qantas Group CEO, Alan Joyce, says.

The company also revealed it had placed orders for a further 24 Boeing and Airbus widebody aircraft from FY27 onwards to replace its current A330 fleet, plus purchase right options for future renewal and growth.

“Travel demand is incredibly robust and we’ve taken delivery of more aircraft and opened up new routes to help meet it,” Joyce says.

“It’s because we’re in a strong financial position that we’re able to invest in new aircraft, new destinations and new training facilities – all things that will make us better in the future.”

Joyce, who was appointed CEO in 2008, will be succeeded by the Group’s current chief financial officer, Vanessa Hudson in November 2023.

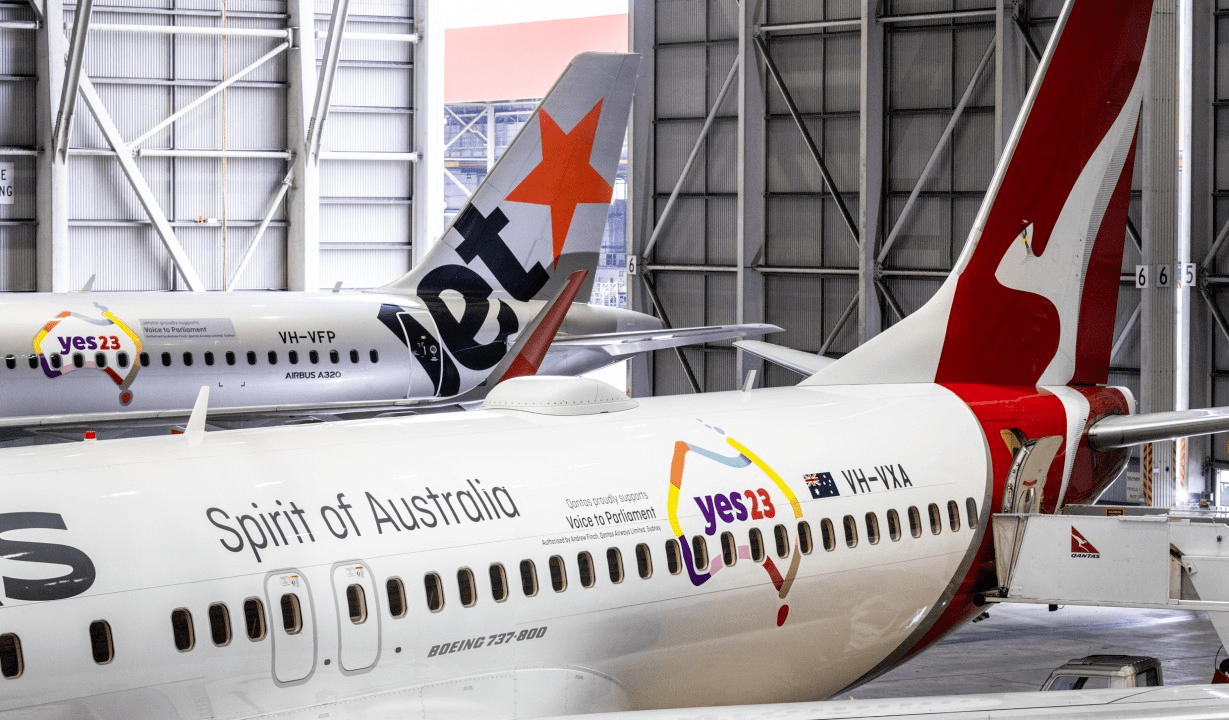

Qantas, Jetstar announce mega-sale

Flight fares peaked in the second quarter of FY23 due to the increased demand and supply chain constraints. Now, domestic fares are 4% higher than pre-COVID levels and international fares are 10% higher.

In light of the recent profits, Qantas Group also announced a mega-sale across its Qantas Domestic, Qantas International, Jetstar and QantasLink carriers. Qantas fares will be up to 40% off, including return flights from Sydney to London for $1799, and domestic fares starting from as low as $29 one-way.

Related

Qantas is also gifting more than a billion Qantas Points across Frequent Flyers who have flown at least one Qantas flight in the past 12 months. The Group states eligible customers will receive an email inviting them to choose between 1,000 Frequent Flyer Points or 30 Status Credits. Those who flew 10 or more times will be gifted 5,000 Qantas Points or 75 Status Credits.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.