Australian venture capitals firms were forecasting late last year that the froth and bubble would normalise for venture capital startup investing in 2023.

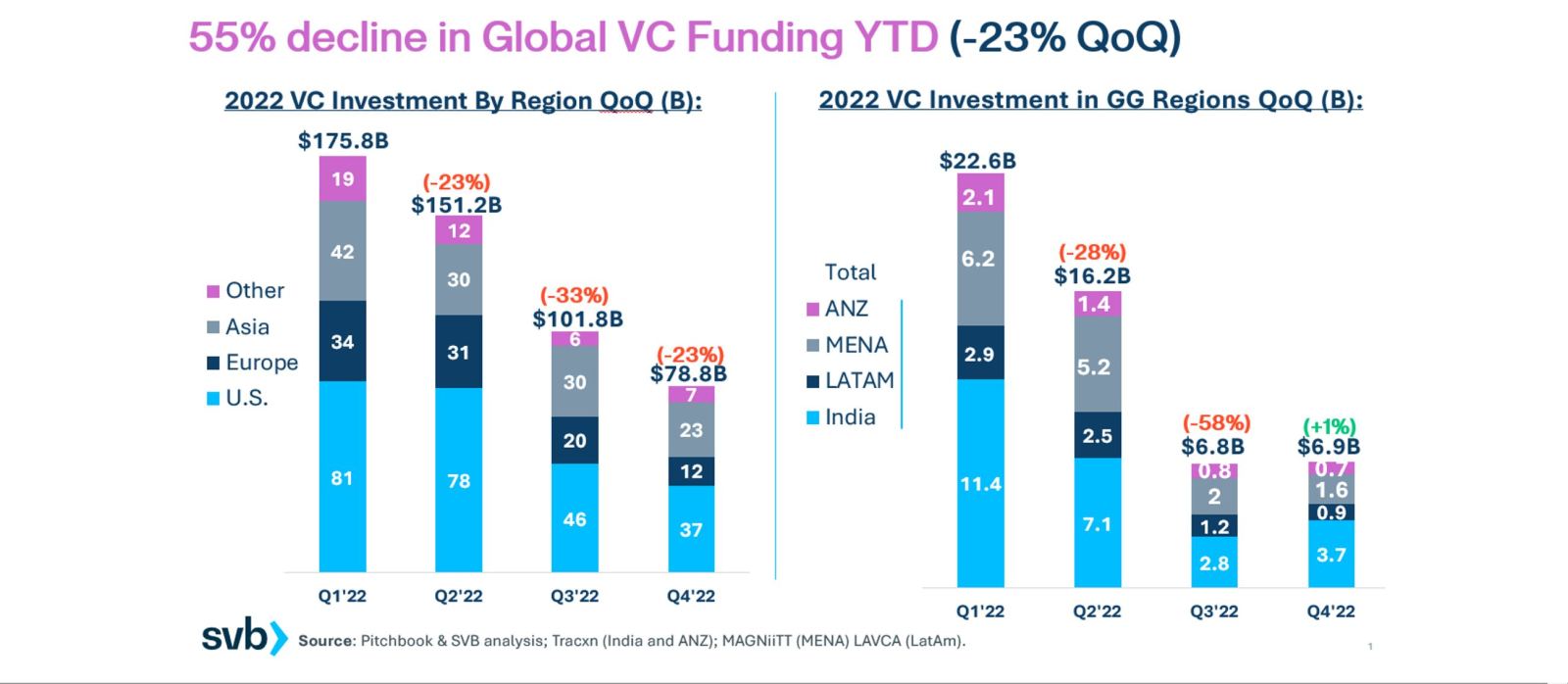

Fundraising by venture-capital firms hit a nine-year low in the fourth quarter, as the macroeconomic pressures that already weighed on technology startups began to affect the investors who underpin the industry, according to data reported by The Wall Street Journal.

Venture firms raised US$20.6 billion in new funds in the fourth quarter, a 65% drop from the year-earlier quarter and the lowest fourth-quarter amount since 2013, according to data firm Preqin Ltd., which tracks venture-fund data.

The amount was also less than half the level raised in the preceding three months, the first time fundraising volumes decreased from the third to fourth quarter since 2009, the data show.

Fund backers, known as limited partners, invested in 226 venture-capital funds in the fourth quarter, the fewest for that time period since 2012, the Preqin data show. By contrast, they backed 620 funds in the last three months of 2021, when technology stocks peaked, the Journal reported.

Here in Australia, 2022 was the second-biggest year for funding on record with 712 deals closed and $7.4 billion funded, led by a strong first quarter. Deal count and total funding declined in the second and third quarters to their slowest since 2020, according to the second edition of ‘The State of Australian Startup Funding Report’ released by Folklore Ventures and Cut Through Venture on February 7, 2023.

Late last year, Australian venture capitals firms said they were expecting the froth and bubble to normalise for venture capital startup investing.

Related content

Dr Michelle Deaker, founder and Managing Partner of OneVentures, one of Australia’s largest VC firms told Forbes Australia that the current climate could lead to enormous creativity across sectors and industry in 2023, particularly in healthcare, AI, personalised medicine, the metaverse, and supply chain and logistics disruption.

In 2022, there was a huge amount of capital in the market, but when the war in Ukraine broke out, and there was rising inflation, a lot of capital was pivoted back to value stocks and also moved into lower risk asset classes, Deaker acknowledges. “So, the market went from being risk on to risk off almost overnight. That meant that we’re now back seeing the amount of money deployed into VC almost at the same level per quarter as pre-Covid times. We’ve sort of seen it normalise.

“What we actually found was there was almost too much money in the market the last year or two, and that was driving very frothy valuations. There was a bit of a bubble happening. I wouldn’t compare it to the bubble of 2000. I think it was a different sort of bubble. We’ve got very good companies here, very good underlying business fundamentals, but there was just too much money, and it was too cheap.

THE LIST

“Now we’ve had that swing to risk off, which means that a lot of people have pre-committed a lot of money, so there’ll be a while before that sorts out. We may move into a period where there’s more capital scarcity, and most VC managers are preparing for that capital scarcity,” Deaker says. “We’re reserving more money for our own portfolio companies, and obviously, there’s a view that coming into 2023, the second half of 2023, valuations and hopefully entrepreneurial mindsets would have reset somewhat.”

Fresh opportunities

However, in the face of a downturn, the opportunity lies in new company creation and early-stage companies, according to Silicon Valley Bank’s Andy Tsao and Sara Rona. “While there is no doubt pain for many startups and founders, at Silicon Valley Bank we remain optimistic about the opportunity for the Australian startup ecosystem in 2023 and beyond,” they said.

Salus Ventures, a new $40 million venture capital fund announced today, will specialise in supporting the growth of Australian early-stage companies that generate sovereign capabilities and a stronger national interest-led technology ecosystem.

Salus Ventures is the first dedicated early-stage Australian fund to invest in mission-driven founders developing cutting-edge technologies with critical application in both commercial and government markets.

Salus Ventures’ co-founders include Dan Bennett, who has spent close to 10 years as Managing Partner of global venture investing platform, OurCrowd, and Marten Peck, an investment executive with extensive experience in building and operating companies, investment management and property, with a strong focus over the last decade investing in venture capital. Joining the founding team as Managing Director is Mike Ferrari, most recently Head of Australia for Salesforce Ventures.

Peck says Salus Ventures has quickly established itself as the ‘go to’ venture fund for founders building innovative and disruptive technology that may have critical positive impact for both commercial and government use.

“Our deep networks and understanding of industry and government will assist and direct our portfolio companies to opportunities both in Australia and around the world. Specifically, we’ll be backing founders and critical technologies with the potential for dual-use application,” he says.

Startup billionaires globally are nearly US$100 billion poorer than a year ago, according to Forbes research, with 44 founders having lost half their wealth in the past 12 months. Twelve were no longer billionaires as at time of the research.