Microsoft becomes second company ever to top $3 trillion valuation

Microsoft joined Apple in the highly exclusive $3 trillion club Wednesday.

Microsoft joined Apple in the highly exclusive $3 trillion club Wednesday.

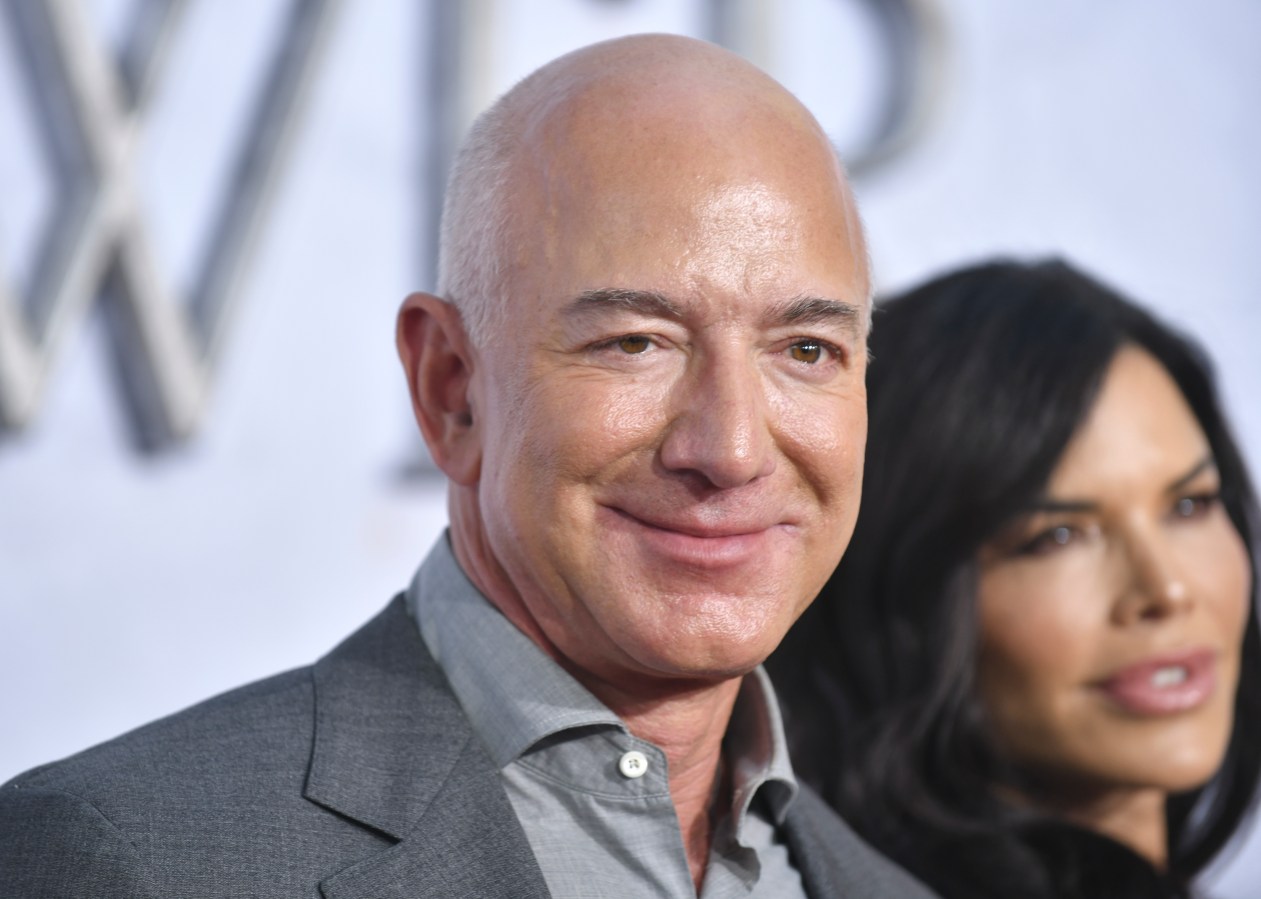

Billionaires around the world are now US$3.3 trillion (AU$5 trillion) richer than they were in 2020, with their wealth growing three times as fast as the rate of inflation, Oxfam’s Inequality Inc report has revealed.

As of January 1, the 10 richest people on the planet are worth nearly $1.47 trillion—$30 billion more than a month earlier. And Facebook founder Mark Zuckerberg has overtaken Bill Gates to become the world’s fifth richest person.

The accountants certified that Tingo Group had $462 million in the bank. The SEC says it was just $50. Short sellers are rejoicing.

At age 21, Zhang Hongchao started peddling shaved ice treats. A quarter of a century later, he and his younger brother Hongfu have made a fortune selling soft-serve ice cream, coffee drinks and its super popular bubble tea and lemonade.

The search giant faced a slew of historic cases this year, including a landmark antitrust trial against the federal government, a bitter fight against the maker of Fortnite, and its first-ever gender discrimination trial.

Finding out who owns Australia’s biggest companies isn’t easy. Data journalist Juliette O’Brien sleuthed dozens of sources to find the answer.

The company’s A and B Class shares were both up more than 10% on Friday.

Spotify shares were up more than 6.8% in pre-market trading Monday morning after news broke that it would lay off roughly 1,500 of its workforce in an effort for the audio streaming service to cut costs amid slowing growth.

Meta is suing the Federal Trade Commission, claiming the agency’s in-house courts are unconstitutional and violate due process protections, a bid that also aims to stop the FTC from making blanket changes to a 2020 privacy violation settlement that would further restrictions on Meta’s data monetization practices.